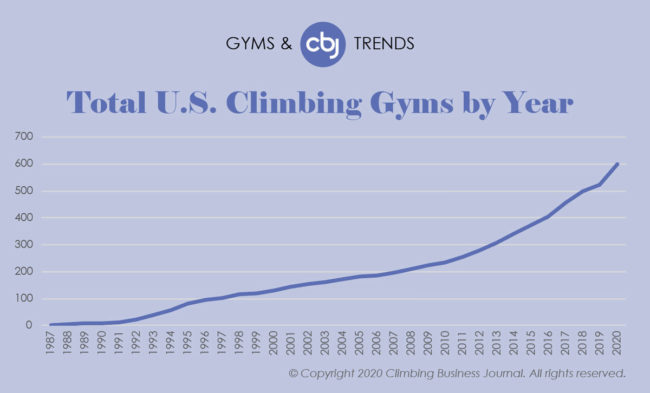

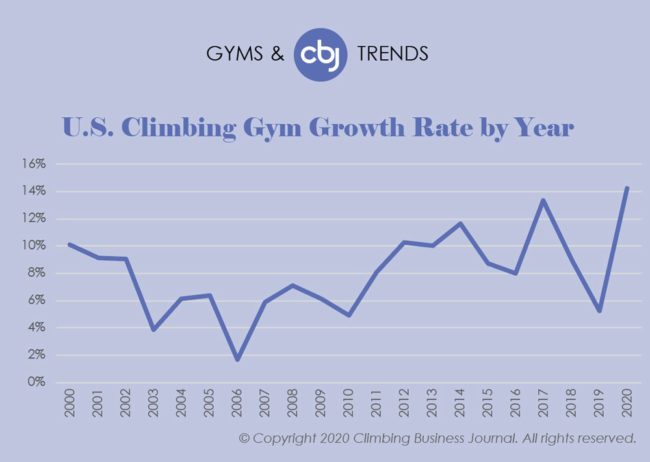

The elephant in the room this year is the surprising fact that the 2019 growth rate of the number of commercial climbing gyms in America was the lowest since our annual Gyms & Trends report first began in 2013. The net number of climbing gyms in the US grew by 5.21% in 2019. 34 new gyms opened their doors for climbing last year, the fewest since 2013 and a drop which follows the most successful year on record in 2018 (those 34 gyms are listed separately in the new CBJ Gym List Awards).

From a consumer standpoint, the industry was fueled by arguably more public interest in climbing than ever before. Anticipation and fandom for the Tokyo 2020 Olympics rose to a fever pitch, particularly in North America—where four competitors earned berths for this summer’s Olympics. Moreover, USA Climbing deepened its corporate roster, an offshoot of which was a notable mainstream interest in the college climbing teams. And a comprehensive State of Climbing Report by the American Alpine Club that tracked climbing participation, in general, in the previous year noted the likelihood of “millions of millennials taking up the sport” in the future. In a word, climbing is more intriguing to the masses than ever before.

So, what gives on the business end? Is climbing proving to be the fad of an industry that quickly boomed, reached maturity and is now on its way out? And specifically why was climbing gym growth in the US down in 2019? More broadly, should gym professionals worry about a slump in 2020 or be expecting an Olympic bump? Answers to these questions and more are explored below.

Methodology: Data Scope and Limitations

Despite the drop in the gym growth rate last year, there are multiple reasons why climbing professionals in the US should not feel worried about a 5.21% growth rate.

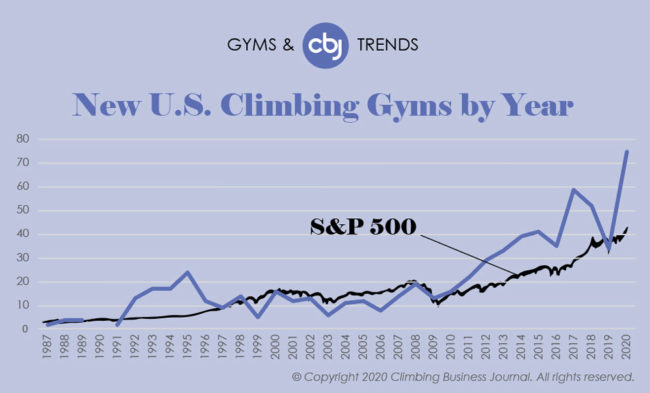

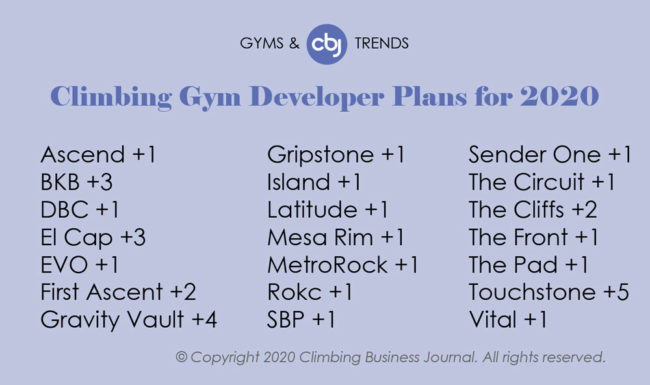

First, the growth of any industry is typically analyzed in terms of stages rather than individual years. According to the Corporate Finance Institute, different industries often progress through a similar industry life cycle: start-up, growth, shakeout, maturity and decline. These stages can develop over multiple years, and thus it can be helpful to compare multi-year growth rates. While the gym growth rate declined in 2019, in 2020 that figure is expected to reach the highest level yet. 75 new gyms are planned to open in the US in 2020. If all those projects are completed, more commercial climbing gyms will open in the US in 2020 than in any prior year (Touchstone Climbing is set to open five new gyms in 2020, the most of any operator), and more gyms would have opened in the years 2018-2020 than in any previous three-year period. Since 2006, the rate of change in the number of US climbing gyms is still an upward trend that continues to rise.

“I think it’s important to look at things over a longer term,” said Mailee Hung, Director of Communications & Community Engagement at Touchstone Climbing. “As we know firsthand, project delays could be a big part of these numbers, and a one-year trend doesn’t necessarily show that the industry is slowing down or changing.”

Second, 5.21% is still a healthy growth rate when compared to other industries and the US economy as a whole. As a prime example, the number of gyms in the health club industry grew by 2.8% in 2019, according to a study by the International Health, Racquet & Sportsclub Association. The gym growth rate of both the climbing and health club industries surpassed the recent growth rate of GDP in the US (2.1% in the 3rd quarter of 2019, compared to the same quarter the previous year). Economists often deem a healthy growth rate for GDP to be between 2 and 4%––with the historical average closer to 2.5% annually––and the healthy growth rate of a “growth company” to be higher than that of the overall economy. Based on the same definition for an industry, the climbing gym industry in America grew at a healthy rate in 2019.

Third, Climbing Business Journal collects data on all new, sold, moved, expanded and closed commercial climbing gyms in the US and Canada. We have just begun to collect data on recreation centers, university, private or other institutional climbing walls—to date we have not included in our data those climbing walls that are part of facilities which are not in the sole business of selling climbing, or facilities that do not offer climbing-specific memberships. As such, the growth rate in the number of climbing walls in the US would likely be much higher. 1Climb, for instance, has donated four climbing walls to Boys & Girls Clubs and other organizations since 2017, and the nonprofit organization is set to double that number in 2020 (with the goal of introducing 100,000 kids to climbing). Additionally, internal climbing gym expansions are not accounted for in the gym growth rate. Renovations which increase the square footage or climbing surface of an existing facility will not be reflected in this figure, and neither will the acquisition of an existing gym or chain of gyms by another gym brand, one of the trends in 2019.

“A lot of my business this year has been for existing gyms upgrading their facilities to better compete with the new gyms coming to their markets,” said Mike Palmer, Founder/Owner of Cascade Specialty & Flooring, based in Washington.

Finally, many industries measure growth in terms of total industry revenue, not in terms of total facilities, which can vary especially based on the particular stage of the industry’s life cycle. Sometimes, industry revenue grows at a higher rate than the number of facilities. In the US health club industry, for instance, the growth in total revenue outpaced the growth in the number of gyms by 5% in 2018, according to the study referenced above. Revenues at US climbing gyms may be increasing as well, and possibly at a higher rate than the gym growth rate, given the current hype around climbing. Since commercial climbing gyms in the US are not required to report earnings and some prefer not to do so, reliable revenue data has been difficult to obtain over the years and this information has not been included in our annual Gyms & Trends reports.

2019 Gym Data Trends

Climbing Business Journal observed several trends surrounding the data of commercial climbing gym growth in the US in 2019. To learn more about the “why” behind these trends and get to the source of the evolving gym scene, we also reached out to a plethora of the major gyms and brands driving the development. Below are six major figures from 2019 that stood out to us.

16: number of El Cap gyms, now the largest climbing gym chain in North America

The climbing gym industry in the US is likely still in its growth stage, but that doesn’t mean there isn’t some overlap with the shakeout stage, when an industry begins consolidating. One micro-trend of 2019 was an abundance of internal and external corporate expansions, including acquisitions and mergers across state lines.

Chief among these expansions was El Cap – the corporate parent company that initially formed in 2018 through a merger of the Planet Granite and Earth Trek gym chains – acquiring the Movement gym chain in the state of Colorado at the end of 2019. This acquisition brought the total number of gyms under the El Cap umbrella to 16, and the annual number of gym attendees served by the El Cap family to approximately four million people. In just two years, El Cap catapulted to the largest climbing gym chain in the US, a feat accomplished almost entirely through external expansions (El Cap opened one new gym in 2019, the Planet Granite bouldering facility in Fountain Valley, California).

El Cap may not be done acquiring gyms either. “Should that type of opportunity present itself again, we will certainly be open to exploring it,” said Robert Cohen, CEO of El Cap.

Movement’s co-founder, Anne-Worley Moelter, identified the move as a strategic decision for Movement to become part of a larger group. “I believe that our industry is on the cusp of its next big, defining moments and Mike and I are confident that the group at El Cap has the experience, the knowledge, and ideas for innovation that can take us to the next level,” said Moelter.

Elsewhere, Origin Climbing and Fitness in Henderson, Nevada became part of The Pad Climbing network, which has other gyms in San Luis Obispo and Santa Maria, California. Together the gyms formed a new parent company, called Ascent Ventures.

In November of 2019, only months after Transcend Bouldering Lounge opened in Youngstown, Ohio, the new gym became Ascend Youngstown, thus creating the Ascend network that includes the original facility in Pittsburgh, Pennsylvania.

The trend of acquisitions in the US climbing industry in 2019 was not unique to gyms. In June of 2019, Evolv was acquired by the Oberalp Group, an Italian company that also owns Salewa and Wild Country. The following month, Sterling Rope was acquired by Sherill, Inc., an arborist equipment company based in North Carolina.

53: percentage of new gyms in the US in 2019 that were expansion gyms

While some gyms were acquired by larger parent companies, others stayed independent and branched out with additional facilities. In fact, expansions comprised 53% of new climbing gym openings in the US in 2019, the highest percentage of the last three years.

Five Central Rock gyms opened, which was the most of any developer in 2019. Central Rock opened gyms in Stoneham, Boston and Waltham, Massachusetts (the first offers roped climbing and bouldering, the latter two bouldering only) as well as in Buffalo and Rochester, New York—both of which feature roped climbing and bouldering. For reference, the top three developers in 2018 (El Cap, Gravity Vault, and Central Rock) each opened only two locations that year.

Joe Hardy, Co-Founder & Co-Owner of Central Rock Gyms, told Climbing Business Journal the initial plan was to open four gyms in 2018 and four gyms in 2019. “Sometimes development projects just get pushed out. Regulations, real estate challenges, inspections, and construction can all push timelines months or even years,” said Hardy.

Climb Time – which has long served the greater Cincinnati, Ohio area – added a location in Oakley, Ohio. Elsewhere last year, First Ascent opened a Peoria, Illinois location. The Spot in Boulder, Colorado unveiled another eponymous bouldering gym in Denver, and EVO opened a youth-focused facility (EVO Kids) in Louisville, Colorado. 2019 also saw a new Vertical World location (Vertical World North) open in Lynnwood, Washington.

0: number of new gyms in the US in 2019 with more than 25,000ft² of climbing surface

In 2013, four gyms with at least 28,000 square feet of climbing surface opened in the US, all cracking the list of the top ten biggest climbing gyms in America at the time. In 2019, that number dropped to zero; there were no new climbing gyms last year with more than 25,000 square feet of climbing surface.

However, multiple brands that we reached out to commented about the increasing size of climbing gyms. Are they mistaken and the average size of climbing gyms is decreasing?

As with the gym growth rate, it can be helpful to assess the situation over a longer period. By the end of 2013, there were ten climbing gyms with at least 28,000 square feet of climbing surface. Just five years later, that number more than doubled by the end of 2018; there are now 22 climbing gyms with at least 28,000 square feet of climbing surface, and more towering climbing walls from some of the largest gym chains in the US are planned for 2020. As with the gym growth rate, the size of climbing surface is still trending upward, despite a dip in 2019.

In addition, climbing gyms may be increasing in terms of overall facility size and service offerings. Fitness centers, yoga studios, work spaces, dining areas, speed climbing walls, training boards and other accoutrements were coupled with climbing at countless new gyms in 2019.

Multiple factors could be contributing to an increase in the size and complexity of climbing gyms, but most of the experts we heard from acknowledged that—while not yet saturated on a national scale—competition is heightening in specific markets. This increase in competition may be compelling gym operators to outpace their competitors in terms of both quality and quantity.

“We have observed over the past decade of consulting climbing gym start-ups an increased number of rival factions vying for the same coveted target markets (even in lower profile markets) as well as an increase in the overall size of full-service facilities and increased capital required to launch projects, all of which may contribute to longer potential project delays,” said Timy Fairfield, Founder/Owner of Futurist Consultants.

Summit Climbing in Texas and Oklahoma expanded its chain of gyms by adding the mammoth Summit Plano, the 9th climbing gym in the increasingly competitive Dallas-Fort Worth area. The 32,000-square-foot facility boasts 25,000 square feet of bouldering and rope climbing – with walls as high as 55 feet – and is now the largest gym in the DFW area (the 36,000-square-foot Oso Climbing Gym is due to open shortly in Dallas in 2020).

The Front Range of Colorado – considered by many to be the climbing capitol of North America – appears not yet saturated either. Whetstone Climbing opened 20,000 square feet of climbing terrain in Fort Collins, one of the largest climbing gyms to open in 2019. Even more development in high profile markets is on the way in 2020, with multiple large gym projects announced in Colorado, California, the Pacific Northwest, Brooklyn, Philadelphia and Chicago.

300+: number of new gym openings announced in the US since 2010

While often breathtaking for climbers, larger full-service facilities can require more capital to launch and operate. Many brands we reached out to observe an increase in private equity flowing into the climbing gym industry and commented on how this trend is making gym projects more competitive in higher profile markets.

Jackie Hueftle, Co-Owner of Kilter Climbing Grips, said, “As far as we can tell, more money to invest in the facility and its quality of services just creates more money on the back end. If the gym is a nice place to go and exercise or hang out…you have a community there…and [when] you’re not embarrassed to take visiting relatives…that’s a pretty good sign for longevity.”

“Private equity has allowed some gyms to expand rapidly,” Palmer put it pointedly.

A perceived increase in private equity may help gym operators invest in larger climbing gyms, but larger spaces still require more raw materials, and multiple brands observed a roadblock on the supply side of the equation last year which may have contributed to the drop in the gym growth rate and count of large gyms. Businesses can only sustainably grow so fast and climbing wall suppliers may have needed more time in 2019 to catch up to the continuous demand for new climbing gyms in North America. For the last 10 years, the climbing gym industry in the US jumped to over 500 gyms, more than twice its level at the start of the decade and a significant demand for climbing wall suppliers to match in a relatively short span of time – especially as those gym projects increase in size and complexity. However, we received no comments from climbing wall suppliers to confirm these observations.

“What I have seen more this year is more complex real estate developments which have encountered unforeseen delays. Wall builders have also been very busy, and it feels like they are at capacity. I’ve seen gyms delayed just due to the wall builders’ schedules,” said Palmer.

“We’ve also heard that several major wall builders are backed up, meaning projects can’t open as fast as people would like them to. Basically, the interest is there but the logistics are a challenge,” said Hueftle.

80: percentage of new gyms in Canada in 2019 that are bouldering gyms

Not all gyms chose to compete in higher profile markets last year. Gyms continued to proliferate geographically across North America, with new development taking place in all eight divisions of USA Climbing’s competition boundaries. Development also took place outside the continental states. The new El Bloque bouldering gym opened in San Juan, Puerto Rico last Summer.

In fact, smaller states and areas traditionally lesser known for climbing boasted perhaps the most development in 2019. Of those 34 new US gyms that opened in 2019, many were in Ohio and Massachusetts (four gyms in each state), whereas larger states like California and Texas only saw four gym openings altogether in 2019. Colorado, however, also welcomed four new gyms.

Regionally, the booming area was the Midwest. In addition to those new gyms in Ohio, two gyms opened in Illinois, one in Iowa, one in Indiana and one in Missouri. All but one of these new gyms are bouldering-only or smaller full-service gyms with less than 15,000 square feet of climbing surface.

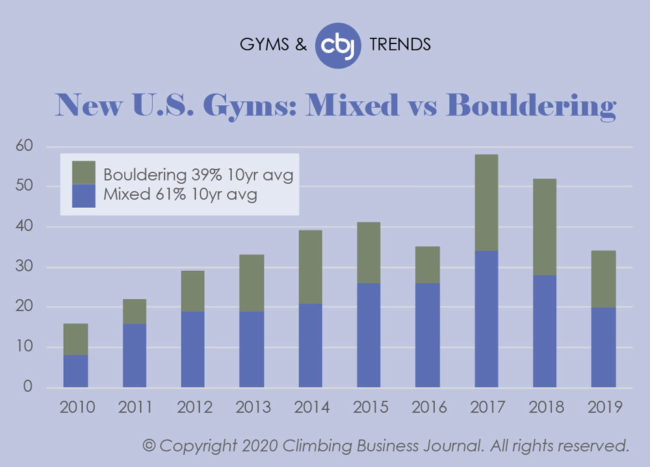

In terms of climbing type, the growth of bouldering gyms versus full-service gyms in the US in 2019 hovered at 2:3, also the average ratio for the past decade (two new bouldering gyms per year for every three new full-service gyms). 14 new bouldering gyms opened their doors for business last year, a return to the norm following the small spike in new bouldering gyms last year (nearly half of all gym openings in 2018 were bouldering gyms).

One place where that ratio did not hold true is Canada. According to our research, 80% of the new gym openings in Canada in 2019 were bouldering gyms. Four bouldering gyms opened in British Columbia (Wip Climbing, Flux Climbing, Gym of Rock and The Hive Surrey), more than any other province, and three bouldering gyms opened in Ontario (Hub Climbing Mississauga, Gravity Climbing Gym and Grand River Rocks Waterloo). One bouldering gym opened as well in both New Brunswick (Fredericton Bouldering Co-Op) and Quebec (Klimat).

The only two full-service gym openings we found in Canada last year occurred in Ontario (Pinnacle Indoor Climbing) and Quebec (Le Relief). Altogether, the number of new climbing gyms in Canada increased to 11 in 2019, up from 8 gym openings in 2018.

0: number of bouldering gyms that closed in North America in 2019

We found eight full-service gyms in the US and one in Canada that permanently closed in 2019, with a geographic expanse that ranged from Hawaii (Volcanic Rock Gym), California (Sanctuary Rock Gym) and Nevada (RockSport) to Arkansas (La Casa Pollo) and Minnesota (Midwest Climbing Academy). Remarkably, every one of these gyms were full-service gyms; we found zero bouldering gyms that closed in North America in 2019.

The reasons for the closures varied, but most gyms and brands that we reached out to pointed to property-related issues, a trend mentioned five years ago in our Gyms & Trends 2014 report. According to a Facebook post, La Casa Pollo was “shut down…for being a couple days late on the exorbitantly high rent.” Rocksport also cited an inability to renegotiate a lease as its reason for closure.

In February of 2019, Sanctuary Rock Gym closed after more than two decades in operation. Owner Michael Bascou announced that the gym’s property owner had sold the land for a new hotel and affordable housing complex. In reportage of the closure, Bascou expressed a desire to re-open the gym somewhere else—“either a full gym with ropes, or a smaller gym with just bouldering.” This month, the gym officially reopens as Sanctuary Climbing & Fitness at a new location in Seaside, California.

2020 Predictions

Without a doubt, climbing’s first adult-level Olympic Games set to take place in Tokyo this Summer is on the minds of many gym climbers and professionals alike. What effect the event will have (and has already had) on the climbing gym industry in North America is yet to be seen, but multiple brands are optimistic the Olympics will positively affect climbing gym business, both in terms of the number of new gym openings and the revenue of existing gyms.

“We do believe that there will certainly be an Olympic ‘bump’ in the years following 2020 and that climbing’s inclusion in the Olympics is a very good thing,” said Seth and Zoe Johnston, Founders & Owners of Teknik climbing holds.

At the same time, multiple brands also acknowledged the possibility of the recession anticipated by some economists negatively impacting the climbing gym industry in 2020. When overlapping the S&P 500 stock market index with the US climbing gym growth rate over the past 30 years, the two economic indicators bear a striking resemblance. It’s not surprising to imagine in the long run gym climbing – a leisure activity – will approach the same rate of change as the overall economy in which it takes place. For this reason, gym professionals should balance optimism with realism and remain vigilant in pursuing data-driven business strategies.

“I know that a few [gym operators] held back from expanding any more because of a future recession,” says Kenny Matys, President & Founder of Atomik climbing holds.

Despite those possible headwinds, based on the 75 announced gym projects, we expect the climbing gym industry in North America to have its best year ever in 2020. Even if just over half of the planned gyms open, the gym growth rate in 2020 will be higher than in 2019. We anticipate additional small projects that haven’t yet been announced will succeed in opening this year. Together CBJ expects at least 60 new commercial climbing gyms to open in the US this year, but only time will tell if our prediction is correct.

Behind the Data

Climbing Business Journal is dedicated to researching and reporting on climbing gym activity in North America.

That is why we put in extra effort for this Gyms and Trends report. When our analysis showed that gym growth in 2019 was the slowest in years, we needed to be sure. We delayed publishing the report and embarked on another wave of research to vet the data more carefully than ever before. We contacted the major wall suppliers of North America, as well as other service providers, to double-check the data in this year’s report. And yes, after all that extra effort, 2019 indeed proved to have the slowest gym growth since 2013. However, that drop doesn’t appear to overshadow anyone’s expectations for 2020 gym growth – 75 new U.S. climbing gym projects have been announced to open this year, which would be the most ever in one year.

The annual Gyms & Trends report of Climbing Business Journal provides climbing industry professionals with a data-driven update on the commercial climbing gym industry in North America. The industry growth rate and accompanying data is compiled through several different source avenues and is completely original and proprietary to Climbing Business Journal. Any climbing gym is welcome—and encouraged—to update or add their information to Climbing Business Journal’s comprehensive gym map and dataset at the following link. Thank you to the team who has supported this research over the years, including Mike Helt, Marlowe Kulley, John Burgman, Joe Robinson, Scott Rennak, Jamie Strong and most of all Jon Lachelt.

Climbing Business Journal is an independent news outlet dedicated to covering the indoor climbing industry. Here you will find the latest coverage of climbing industry news, gym developments, industry best practices, risk management, climbing competitions, youth coaching and routesetting. Have an article idea? CBJ loves to hear from readers like you!