So much happens in any one calendar year, and last year was no exception. In 2023, several developments in the climbing gym industry in North America proved significant enough to transcend the niche climbing gym space and garner headlines in the media at large. For example, one climbing gym chain—Movement—acquired additional facilities that quantitatively made Movement the largest climbing gym chain in the world. Elsewhere, one of the biggest industry news stories of 2023 revolved around a $6 million settlement pertaining to a 2019 auto belay accident at Vertical World in Seattle, Washington. In a wholly different legal realm, more employees unionized at climbing gyms last year than ever before (see below for more info). And as the calendar turned to 2024, climbing gym owners themselves were mobilizing in opposition of USA Climbing’s plans for a new National Training Center in Salt Lake City.

The climbing industry experienced noteworthy global developments too, which included competitions around the world resulting in berths to the forthcoming Paris 2024 Olympics, and a Ukrainian gym parent company—SPACEGroup—opening a new gym and expanding a preexisting one despite the ongoing war (donate to Climb Army here).

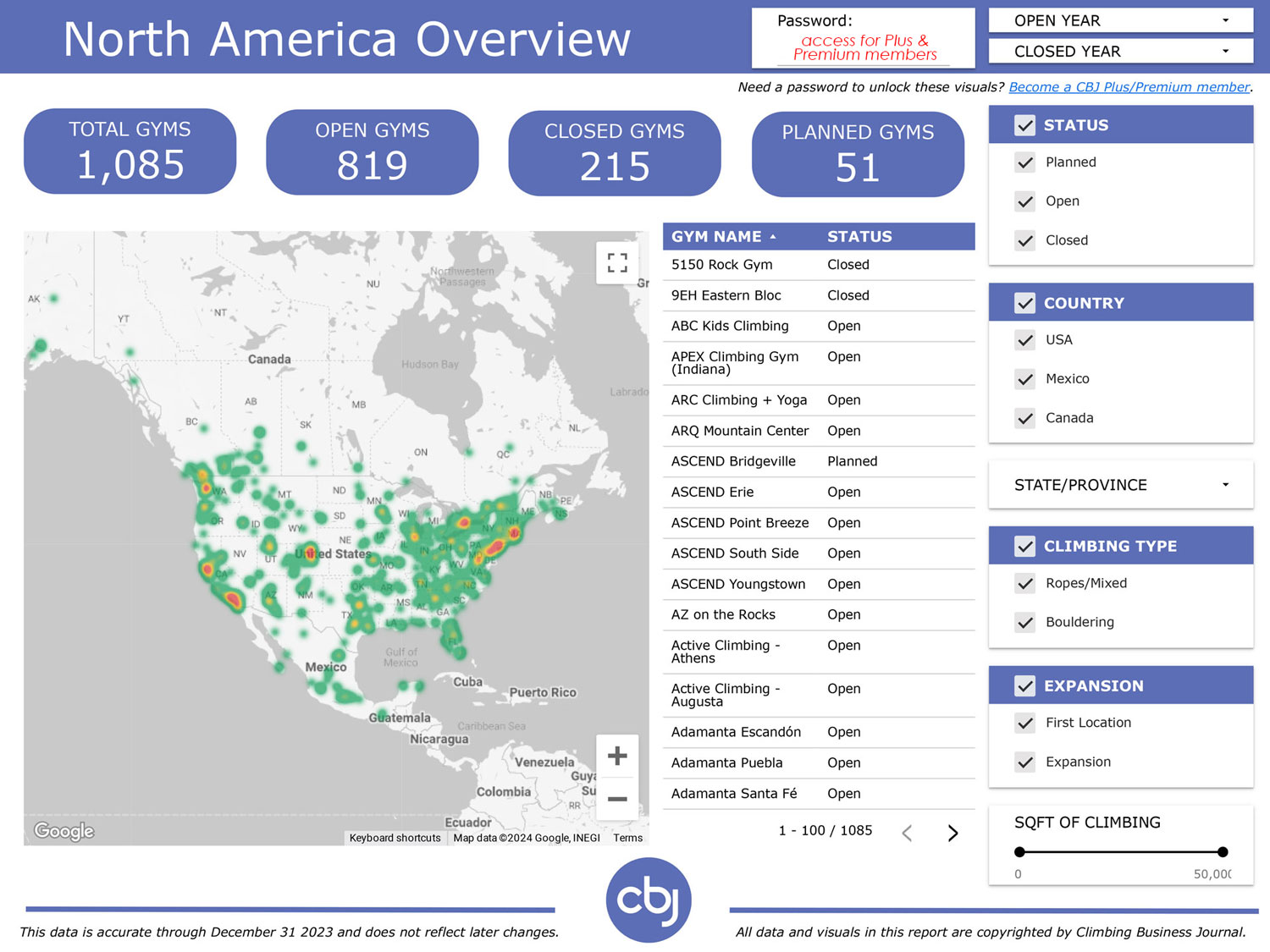

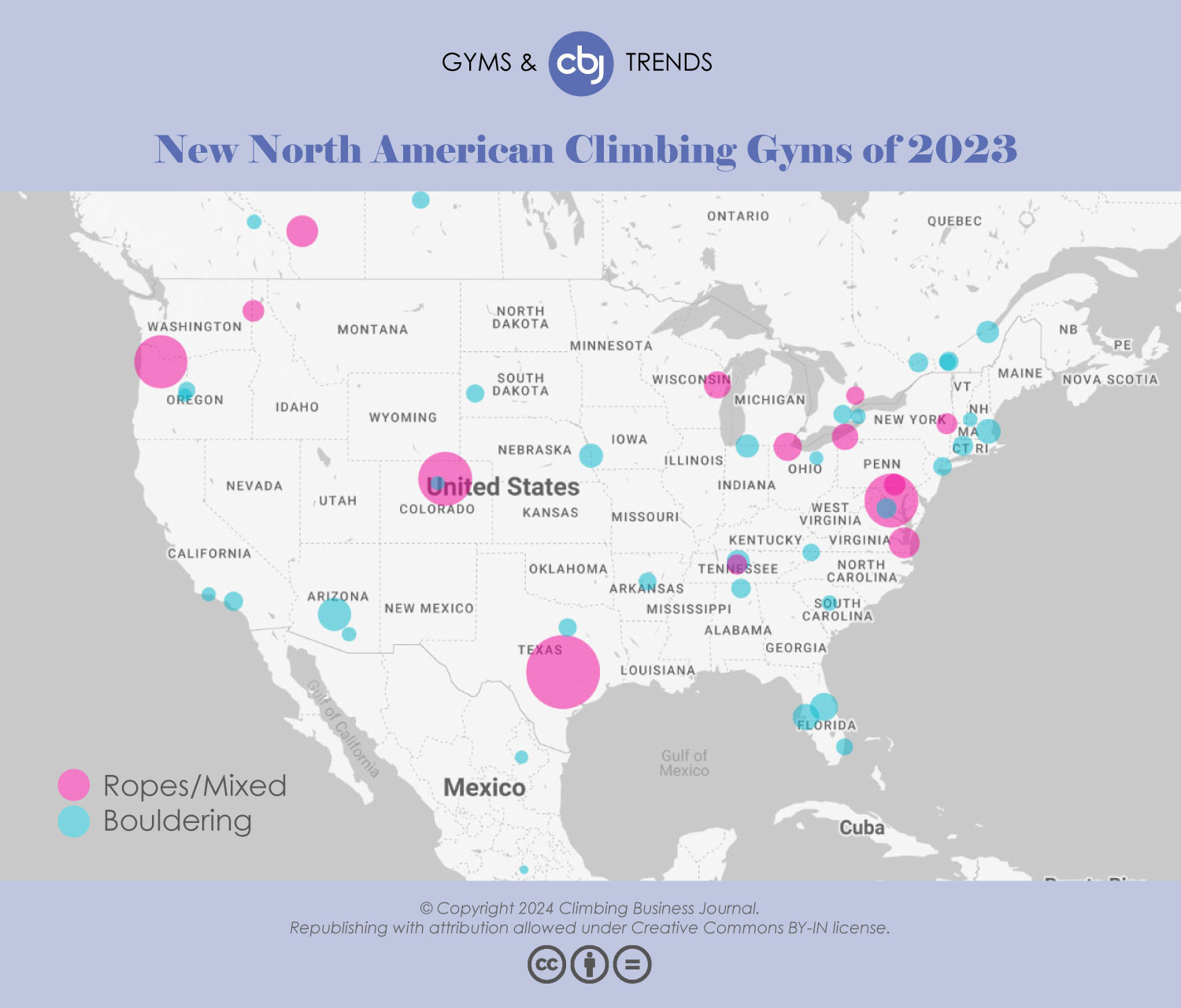

Every one of these developments and others made 2023 a year unlike any other. Yet, when looking at the climbing gym industry in North America, specifically, by the numbers last year, the happenings around the continent were not necessarily unprecedented. That is to say, 2023 featured climbing gym industry trends that were mainly continuations or intensifications of preexisting trends from prior years, rather than trends that were new, emergent or otherwise unexpected. For instance, climbing gym developers continued to explore and locate new and untapped sections of the market for new gyms in 2023. (A full list of the new North American climbing gyms that opened in 2023 and leading developers/suppliers can be found here). And many established developers expanded their climbing gym business by adding new gym locations or acquiring preexisting ones—a trend that was heavily spotlighted in 2022.

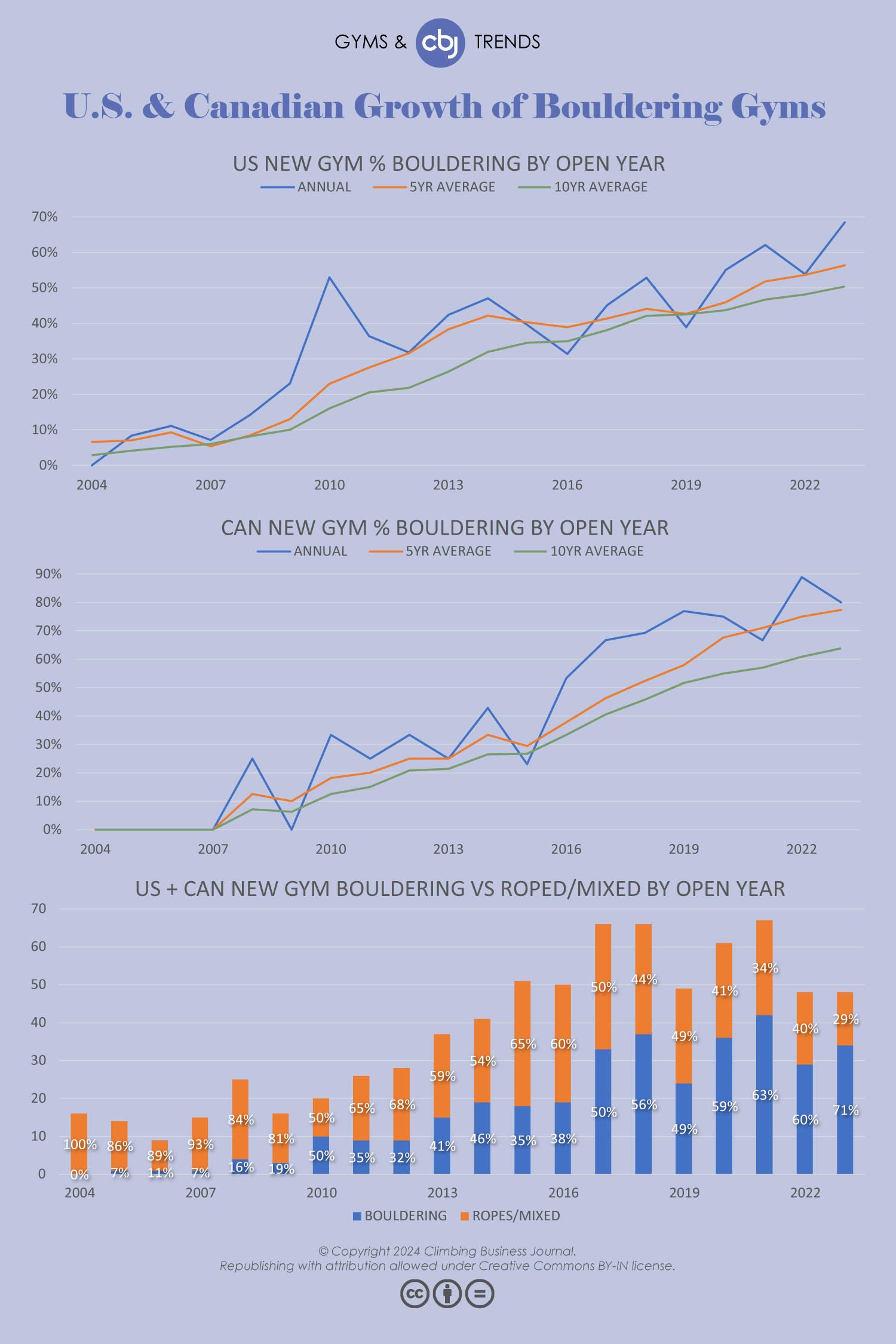

Furthermore, 2023 saw a continuation of a bouldering-focused boom for climbing gym development (which likely contributed to an increased prevalence of training boards as gym amenities); a continued embrace by operators and brands of climbing industry gatherings and trade shows, including the launching of the Indoor Climbing Expo in the U.S. and CIMA in Mexico (see below for more details on the latter); and a continued presence of gym programming noted in prior years (including gym-to-crag offerings and DEI initiatives).

For a deeper dive into the numbers this year, be sure to check out the first-ever Gyms & Trends interactive dashboard in tandem with this report (desktop works best). The dashboard includes 10 pages of dynamic maps, charts, graphs and tables depicting climbing gym growth trends in North America over the years (YoY openings/closures, top developers, 2024+ planned gyms, etc.), with plenty of ways to filter the data (states/provinces, bouldering-only, first location, etc.). The dashboard is available to all CBJ Plus and Premium members and requires a password (contact us if you have not received yours), and a short walk-through video tutorial can be found here. If your business is not yet a member, please consider joining at the following link. Your membership keeps our work going!

Growing Pains

For all intents and purposes, the lingering and far-reaching effects of the COVID-19 pandemic that hit the industry in 2020 continued to impact climbing gym businesses in 2023, much like they did in 2022 and 2021. These effects included ongoing issues with supply chains of materials necessary for gym construction, interest rate fluctuations, extensive delays in construction projects, and general wage issues for gym employees—issues felt by employees in most other industries in 2023 as well. “100% of our new gym [clients] this year opened later than planned due to issues getting holds, staff, or building permits,” says Miura Hawkins, CEO and founder of BETA.

“The global economic landscape in 2023 is characterized by inflationary pressures and fluctuations in the cost of construction materials,” attest DÉLIRE co-founders Jeff Beaulieu and Lisa Lajoie. “Higher costs for building materials, labor, and operational expenses have led potential gym owners to be more cautious about opening new facilities.”

At an operational level, 2023 also featured an abundance of lease-related issues for climbing gym owners, particularly in the U.S., with multiple gyms closing permanently due to the landlord either selling the property (in the case of ROCK’n & JAM’n Centennial in Colorado and GP81 in New York) or not extending the lease (in the case of Vertical World Redmond in Washington). In total, 21 climbing gyms closed their doors across the U.S. and Canada last year, second to only 2020 (26) for the most annual closures ever.

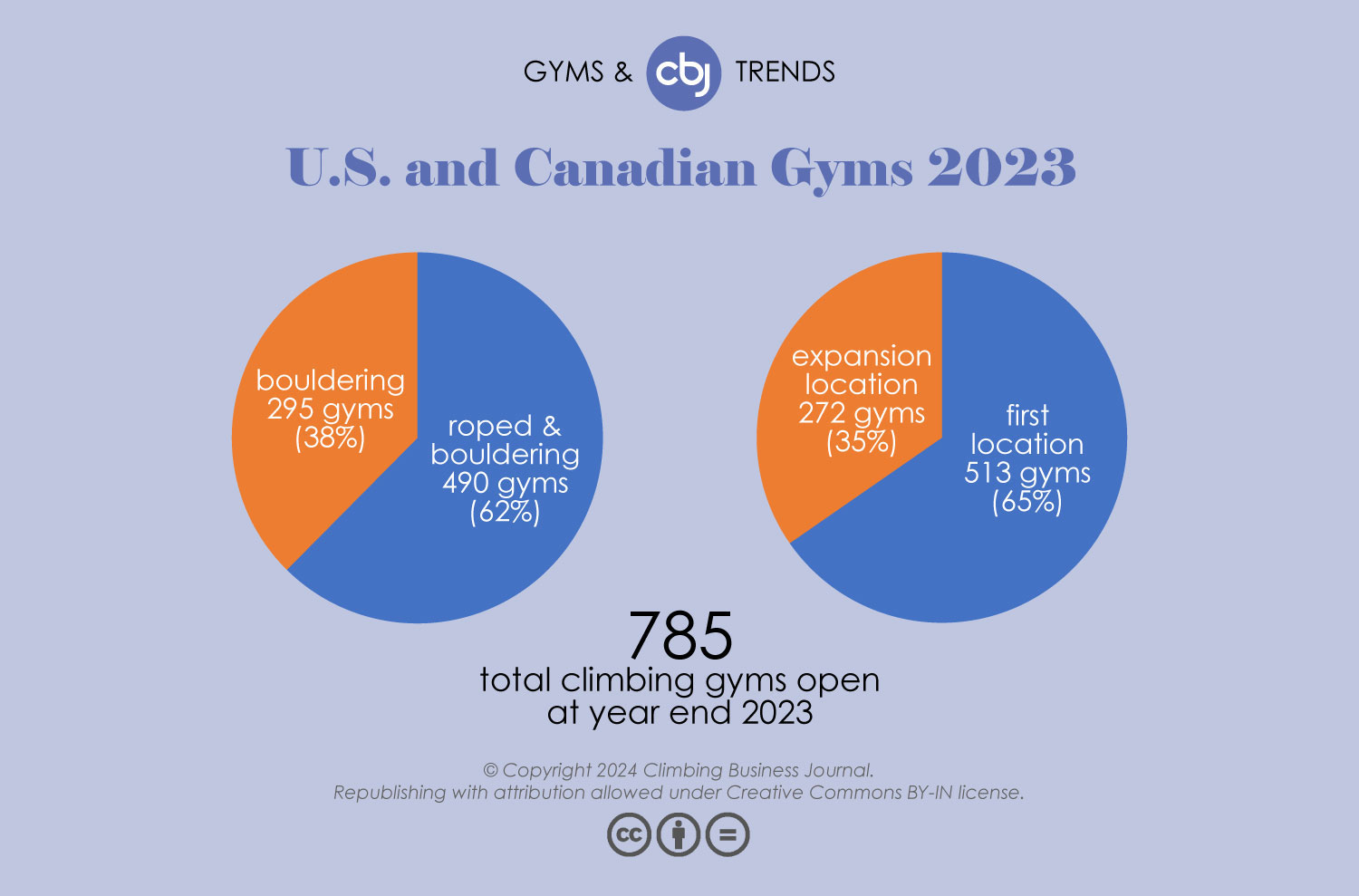

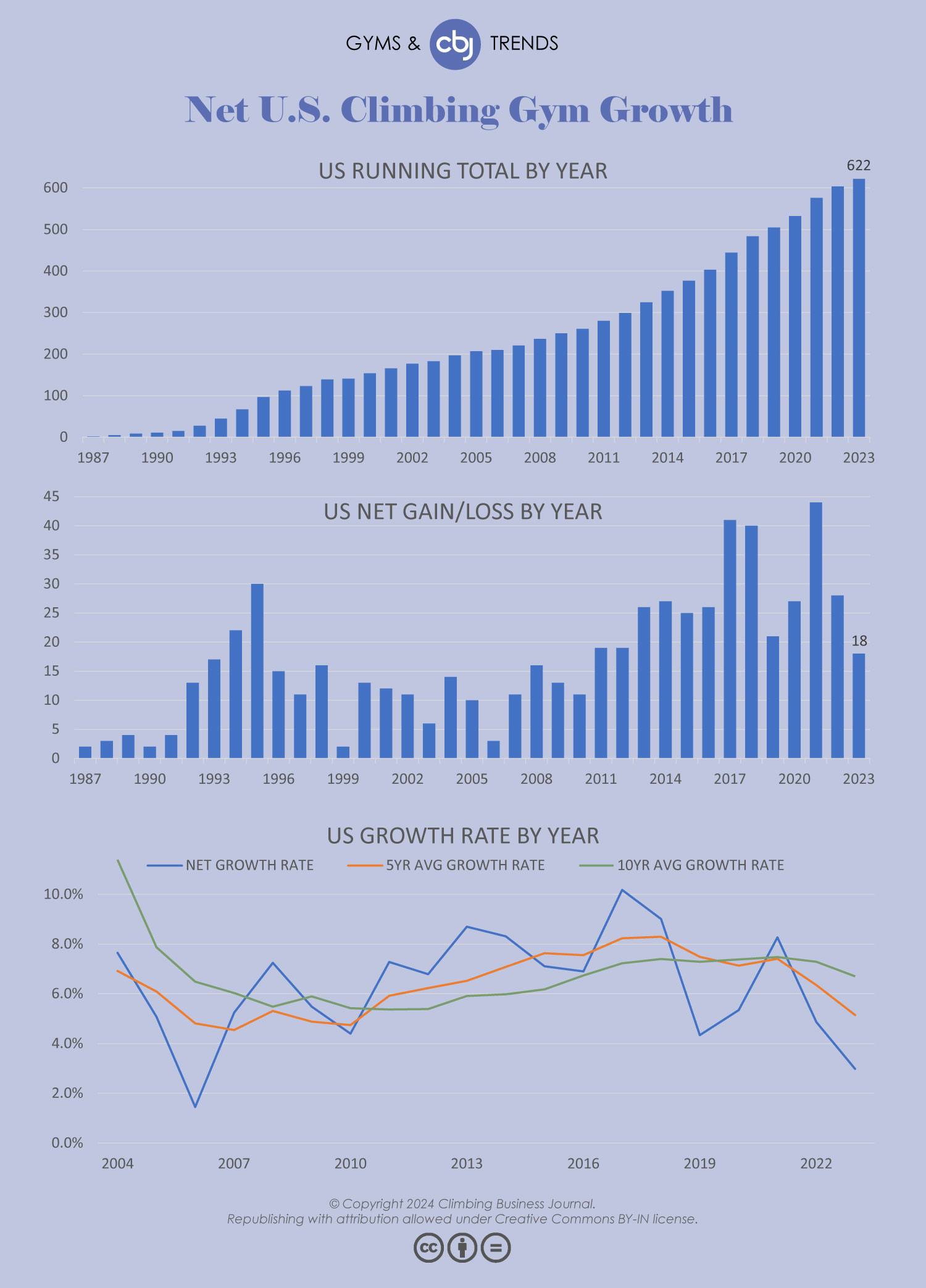

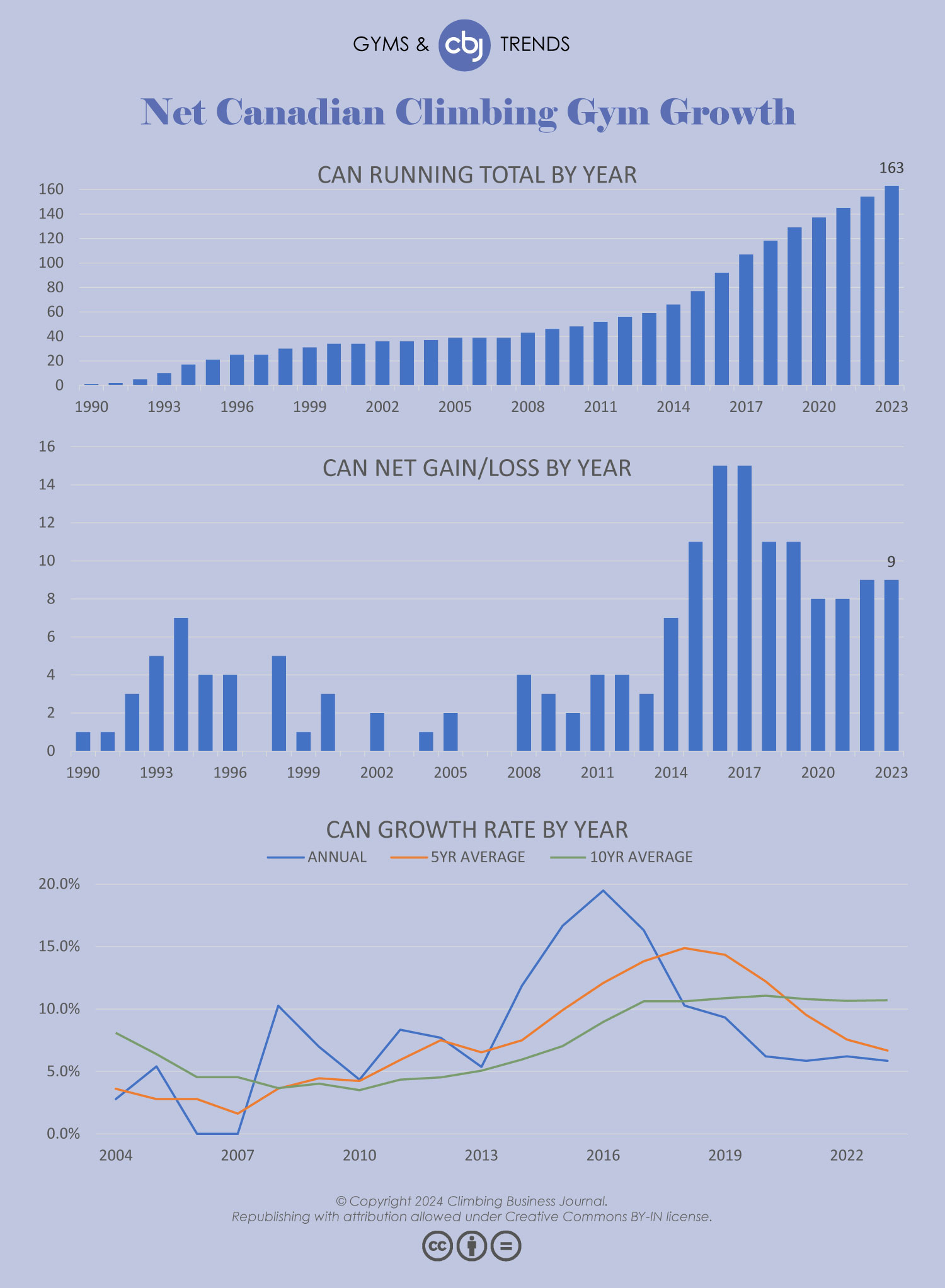

It all amounted to a combined net climbing gym growth rate of 3.6% for the U.S. and Canada, the lowest net growth rate for the industry since 2006 (1.2%). More specifically, a total of 48 new climbing gyms opened across the U.S. and Canada in 2023, or 27 net gyms after subtracting the closures. This figure equated to the second year in a row of a notably slowed growth rate for the industry on the whole, a far cry from the 21st-century best 11.3% net growth rate of 2017.

The Big Picture

Granted, the slowed growth rate—as an extension of 2022’s slowed rate—was not entirely surprising. As noted in previous years’ Gyms and Trends reports, many gyms that opened in the past few years possessed developmental or construction roots that predated the COVID-19 pandemic. However, by 2023, the climbing gym industry had reached a point where most new gym projects (with few exceptions) were entirely post-2020—and since many developers did not start projects during the peak of the pandemic, a lag or dip in growth rate was to be expected at some point. “I think this was the inevitable slowdown due to post-COVID recovery and it was just delayed,” says Jackie Hueflte, co-owner of Kilter. “Hopefully, people will start to be in a position now where they can move forward again.”

Moreover, it’s worth noting that the total number of new climbing gyms throughout the U.S. and Canada in 2023 (48) was still much higher than the annual industry average of 27. In fact, when panning back even further and comparing historical figures in the climbing industry to other industries’, the relative success of climbing gym businesses is rather remarkable. When looking at climbing gyms that opened from 1987-2018, for instance, climbing gym operation across the U.S. and Canada carried a 93% success rate, when measured as new climbing gyms that stayed in business for at least five years. Comparatively, this success rate is far higher than the success rate for adjacent industries. Consider that fitness studios carry a 81% failure rate in the first year of doing business, according to an IHRSA article. And small businesses, in general, have a roughly 50% failure rate by the fifth year, according to analysis of data from the Bureau of Labor Statistics.

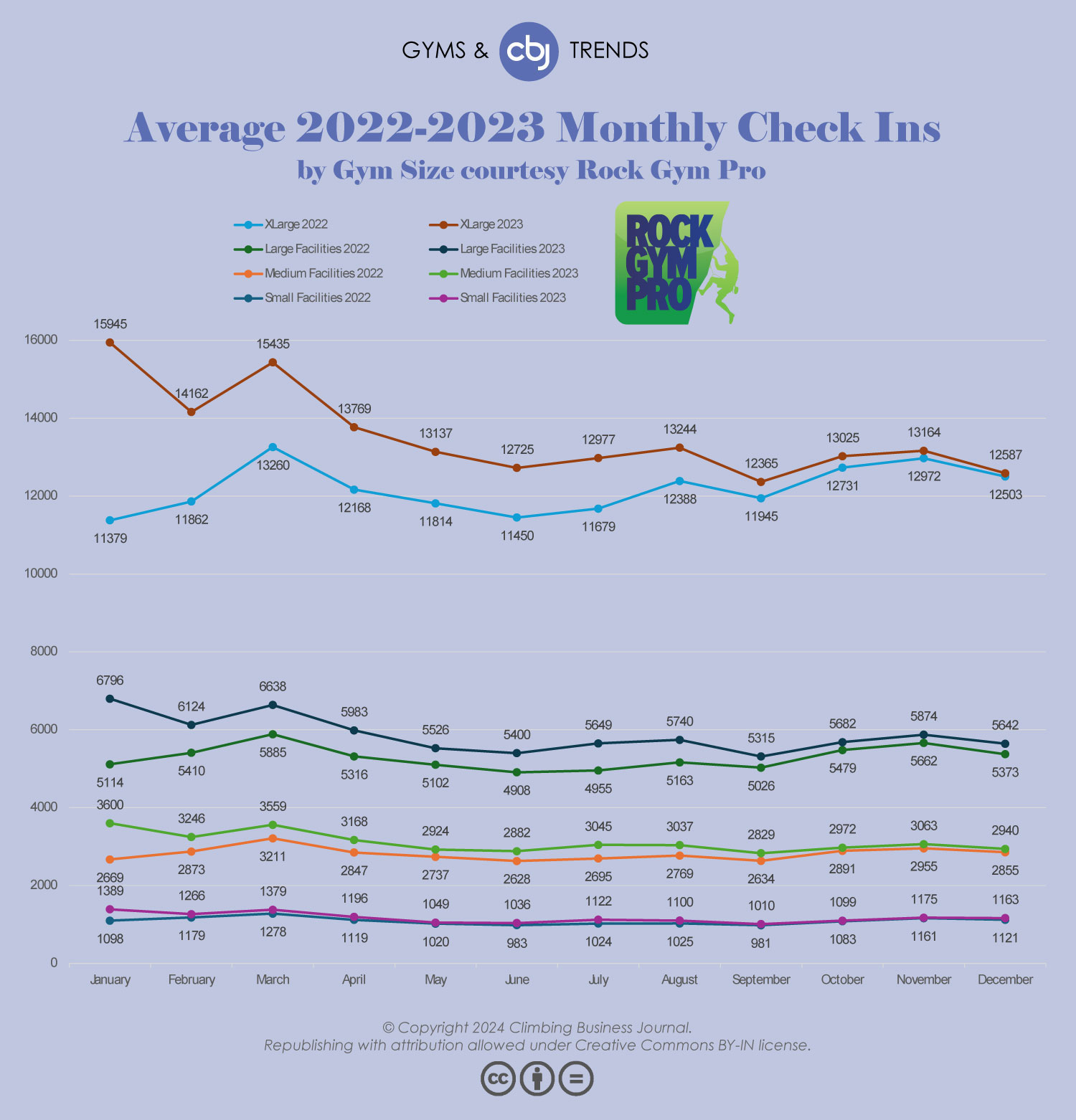

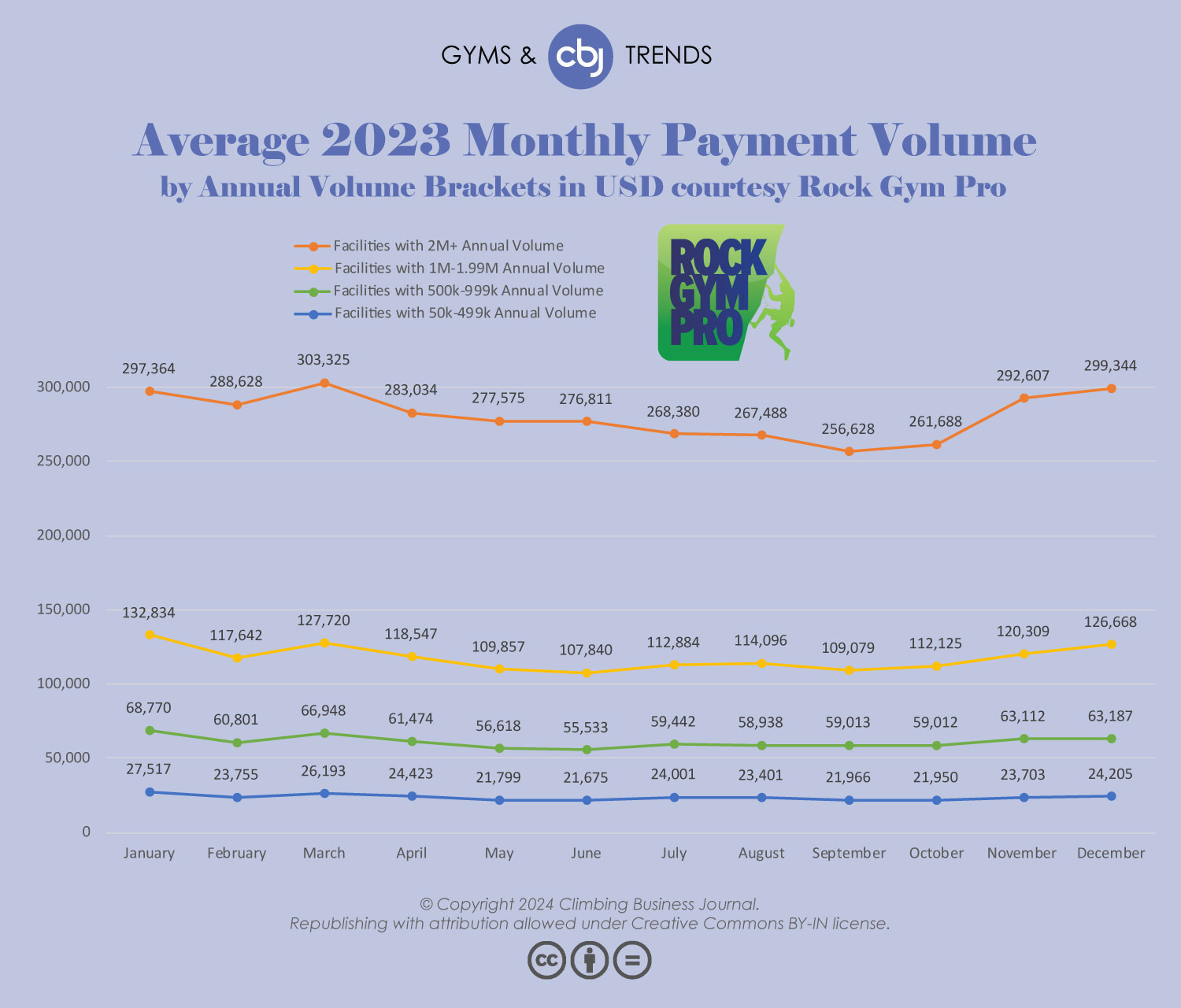

Additionally, the quantity and lifespan of gyms are not the only measures of success; revenue and customer traffic are also indicative of the strength of gym businesses, and there too the climbing industry has been showing signs of overall health. Based on global climbing gym data provided by Rock Gym Pro, averaging monthly check-ins at gyms using RGP increased by about 11% from 2022 to 2023. That growth took place at climbing gyms of all sizes: When splitting the data into four roughly equal quartiles of 150+ gyms per quartile—small, medium, large and extra-large—average monthly check-ins increased by at least 7% from 2022 to 2023 for all four groups. And when looking at average monthly payment volume at gyms using RGP and similarly dividing the data into four quartiles of 150+ gyms, all four groups showed stable revenues over the course of 2023.

Furthermore, as the total number of climbing gyms in existence increases, year-to-year growth rates can be mathematically expected to shrink over time, even while the net number of gyms being added to the market each year remains high, and such was again the case in 2023. On average, the U.S. and Canadian industry grew by a combined 40 net climbing gyms annually from 2014-2023, tied with 2013-2022 for the best ten-year period ever. So, while 2023 possessed an amplification of many of the same woes as 2022 for climbing gym owners and operators, it also provided a reminder of the multi-year strength and economic durability of climbing gym operation.

Corners of the Market

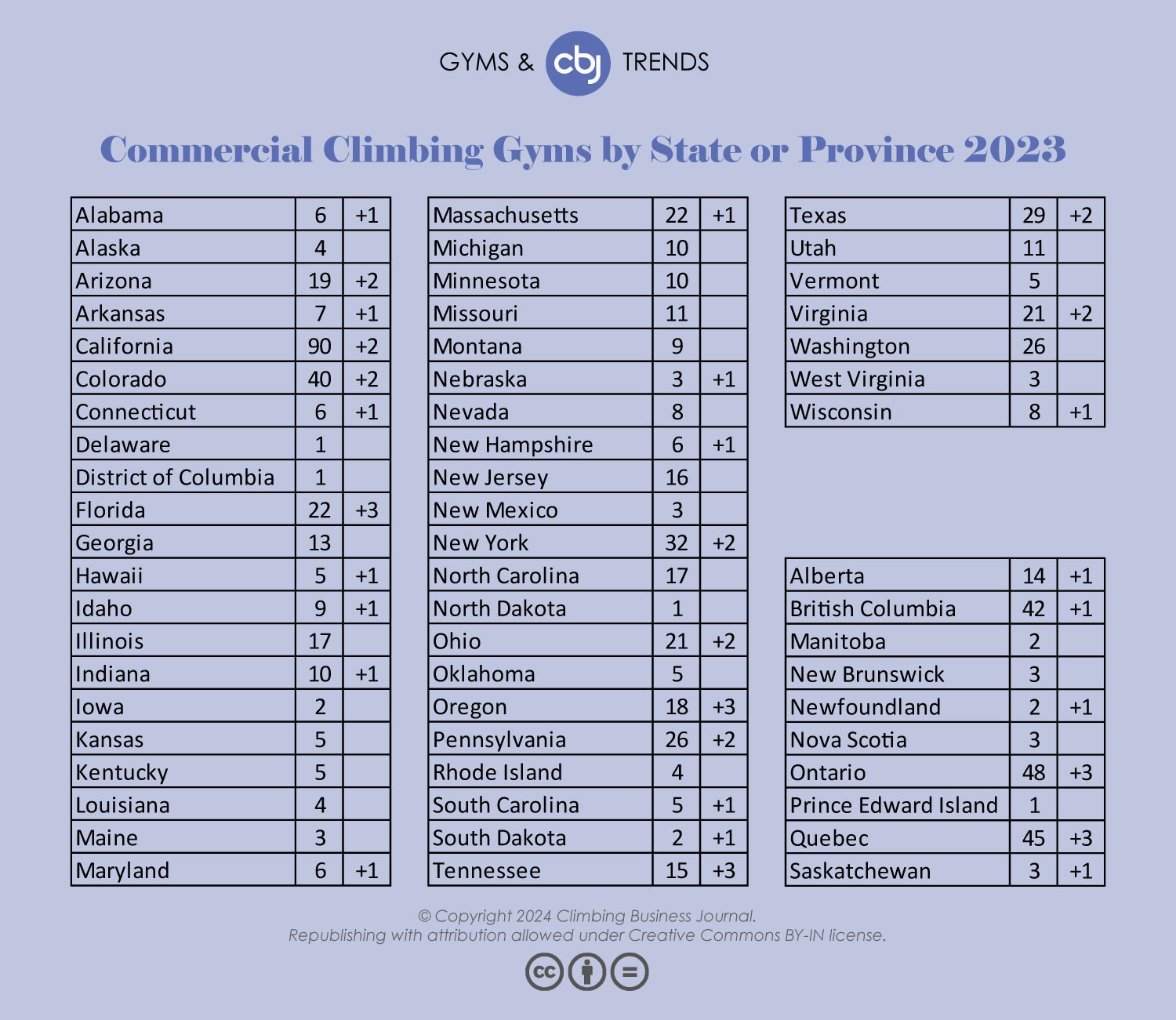

Geographically, the 48 new climbing gyms that opened across the U.S. and Canada spanned 30 states/provinces—the broadest spread since 2011. The prevalence of new climbing gyms far and wide not only speaks to climbing’s popularity on the continent, but it also highlights gym developers’ penchant for finding new, untapped corners of the market.

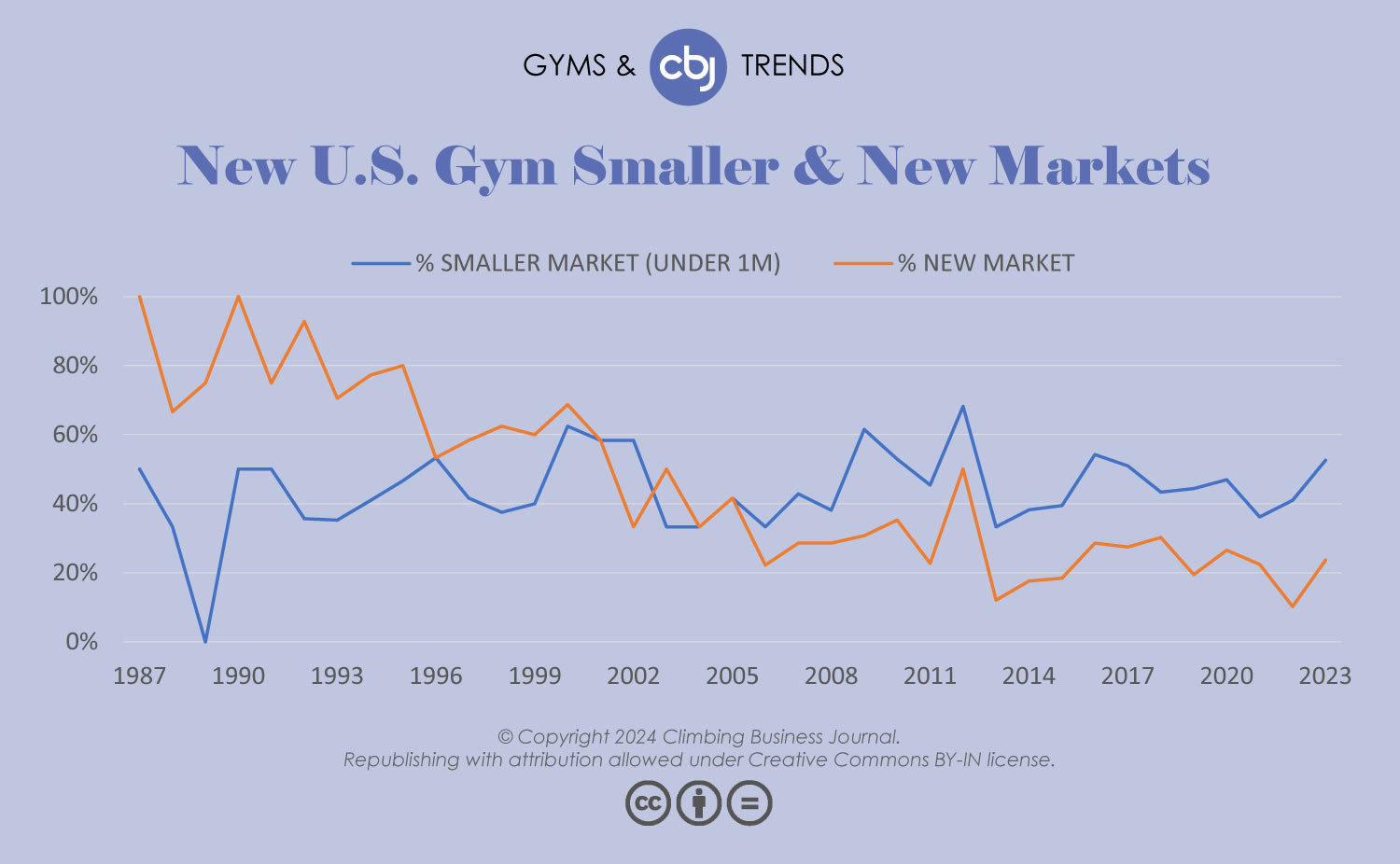

At a more granular level, 2023 featured an uptick in new climbing gyms opening for the first time in smaller and mid-level markets. Based on 2021 five-year American Community Survey data for metropolitan/micropolitan core-based statistical areas (reported by the U.S. Census Bureau), 53% of new U.S. climbing gyms in 2023 opened in markets with a population under 1 million—the highest annual percentage since 2016. Some of the smallest markets included Hilo, Hawaii (Kona Cliffs); Gettysburg (Warehouse Rocks) and Erie (ASCEND Erie), Pennsylvania; and Coeur d’Alene, Idaho (Coeur Climbing Co.). Even larger cities than these—such as Green Bay, Wisconsin (Odyssey), and Toledo, Ohio (Adventus)—received their first-ever climbing gym.

In many cases, the markets receiving a new gym were suburbs or outskirts of much larger markets, but still separate enough by geography or commerce to present a customer base independent of that of the larger city. “Top and second tier locations have gyms, so developers have been looking to smaller towns/cities in order to grow the sport,” summed up Allison Justice, Marketing Director at EP USA.

As an extension of these trends, 2023 also saw the continuation of some developers setting up shop near major colleges and universities. These new gyms included Apex Climbing in Indiana (near the University of Notre Dame), Climb Conway in Arkansas (near the University of Central Arkansas), and Capital Climbing in South Carolina (near the University of South Carolina). This trend was significant because sometimes the nearby colleges already offered climbing in the form of a wall at the college’s rec center or weekend trips via the college’s outdoor recreation programming, yet the market—anchored by a substantial student population—was still viewed as robust enough to support additional climbing offerings not associated with the college in a direct way.

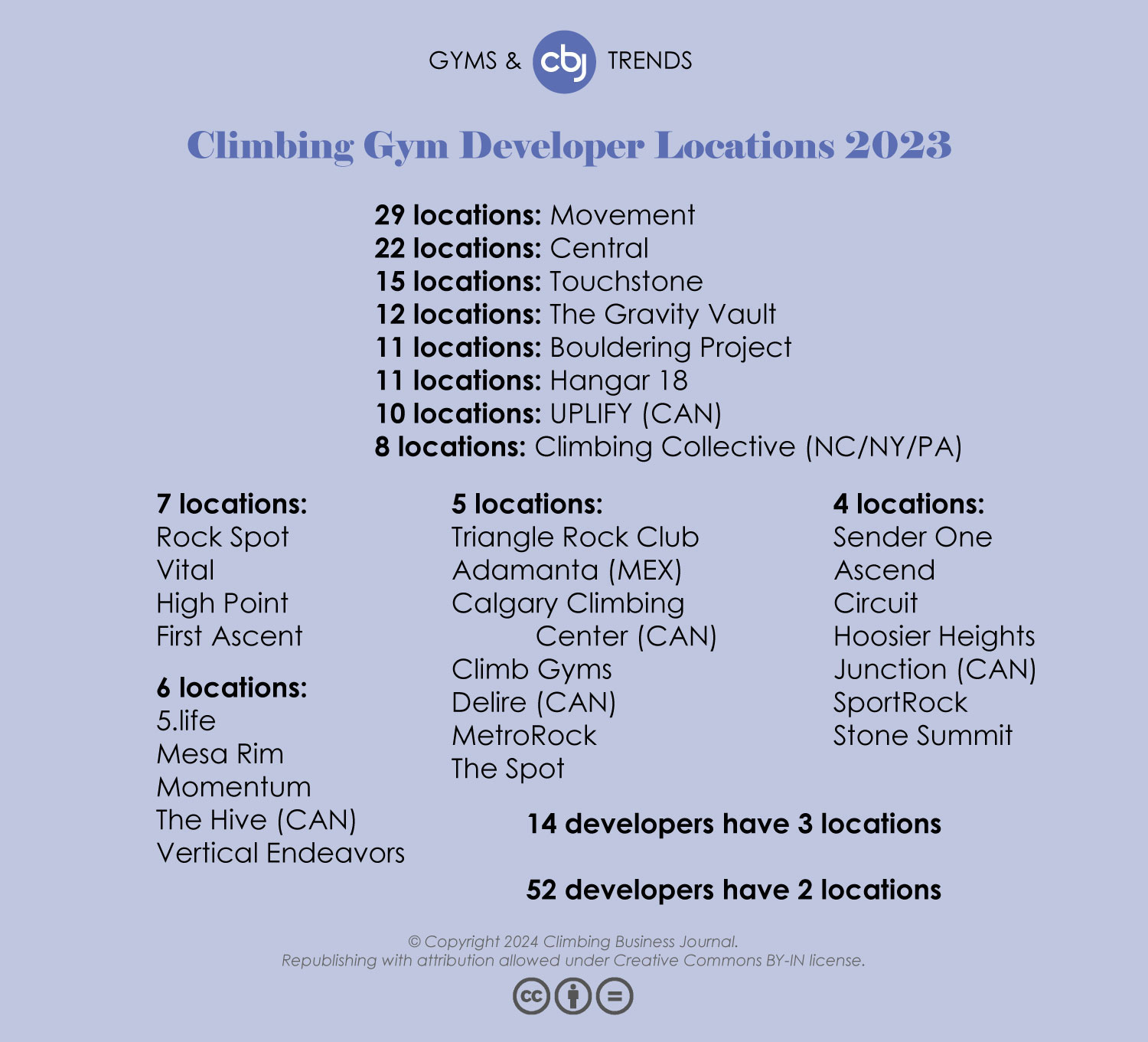

Giants Get Bigger

Another trend that merits analysis is the aforementioned profusion of expansions and acquisitions throughout North America in 2023. Again, there was likely some financial explanation for this trend: By acquiring existing facilities rather than growing organically through the construction of new ones, climbing gym developers avoid some of the challenges noted above that come with starting a completely new gym project from scratch and can typically grow their business at a much faster rate—a factor which is important to potential investors.

“Since COVID, we have noticed a growing trend among the biggest climbing gym chains: acquire existing facilities,” observes Laura Cole, Product Leader at Rock Gym Pro. “Although acquiring an existing business provides its own set of complex issues, there is an argument to be made that it can be the more affordable option compared to establishing a new location from scratch. So, instead of seeing new gyms popping up around the world, we are seeing an increase in facilities changing ownership.”

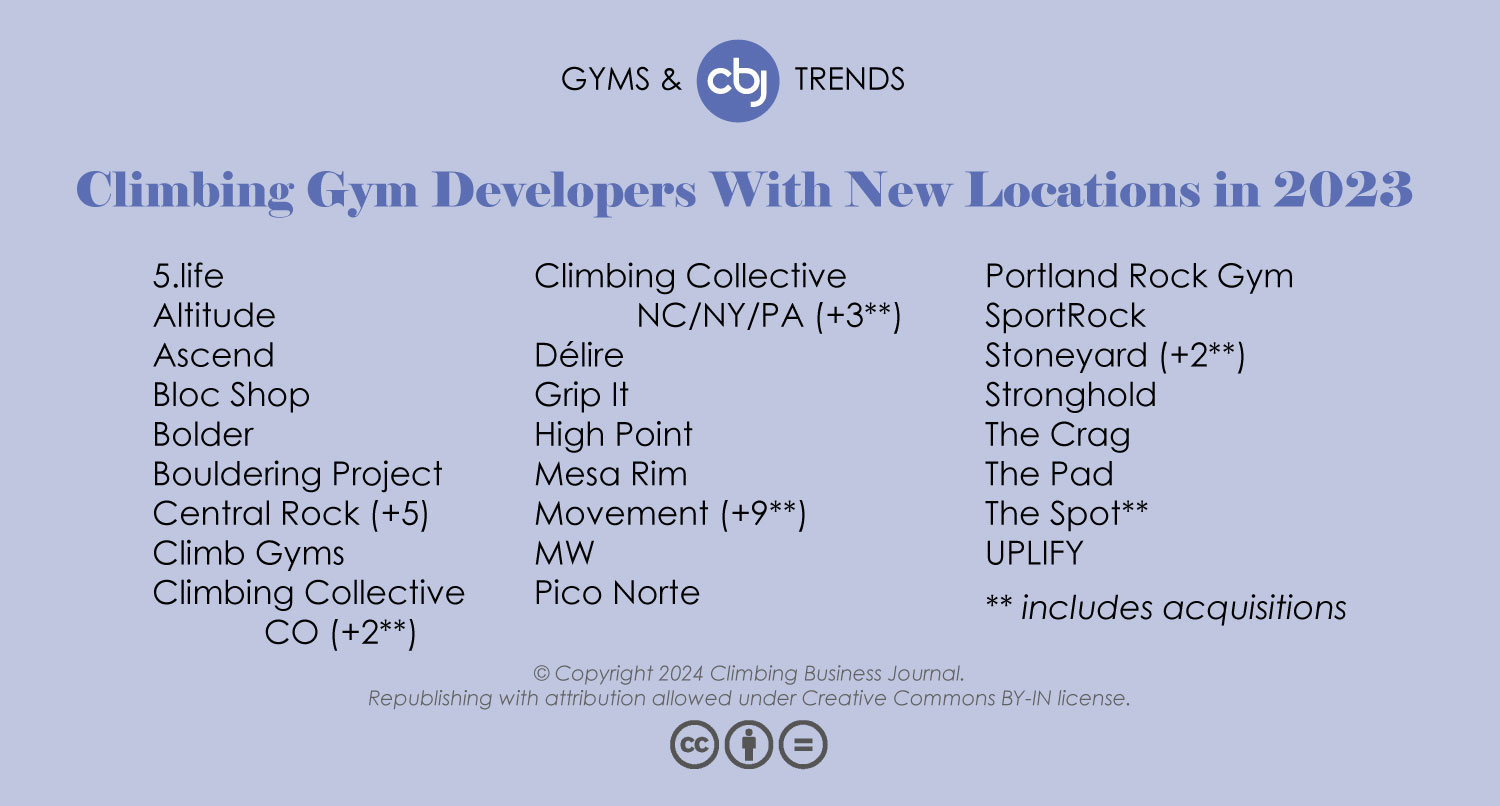

In terms of acquisitions, Movement stole the show in 2023. The coast-to-coast climbing gym operator acquired (and rebranded) nine gyms altogether last year (four Summit Climbing + Fitness locations and all five The Cliffs locations). Other climbing gym acquisitions throughout the year took place in Colorado, with Wooden Mountain becoming Loveland Climbing Collective and ROCK’n & JAM’n Thornton joining The Spot; and North Carolina, where Inner Peaks teamed up with Philadelphia Rock Gym.

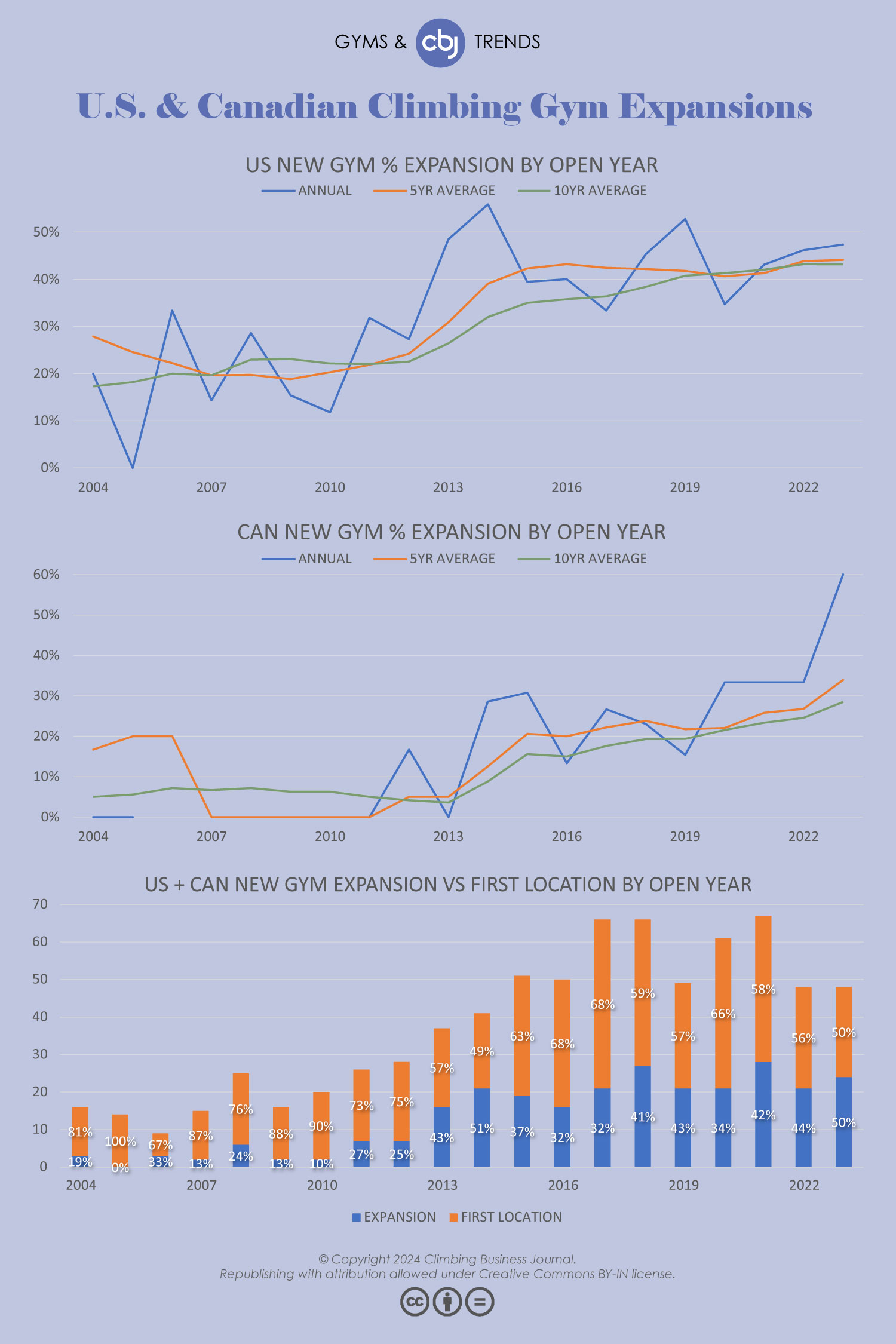

Climbing gym chains can also have an advantage when it comes to opening new facilities, having an existing body of development and operational know-how off which to build and established financials to show banks and investors. “As an assumption, it seems the larger developers have the money/credit to use vs. the first-time developer,” added Chris Morgan, Climbing Sales Director and Product Line Manager at UCS. To that point, the percentage of new climbing gyms in the U.S. and Canada last year that were expansions of gym chains (50%) was the highest annual percentage since 2014 (51%).

Bouldering Booms in Canada

As mentioned at the onset, a vast majority of the growth in all markets in 2023 was via bouldering-focused facilities, which remain extremely popular for developers in part because they generally have lower startup and operational overhead costs and can be completed faster than larger, full-service facilities. In fact, across the U.S. and Canada, CBJ can assert that the average annual quantity of new bouldering-focused gyms from 2014-2023 was the highest of any ten-year period in the industry’s history (29), and the percent of bouldering-focused gyms compared to roped/mixed gyms over that ten-year span was the highest ever as well (53%).

The proliferation of bouldering and expansion gyms across the continent is especially pronounced in Canada, specifically, where 80% of new climbing gyms were bouldering-focused and 60% were expansions in 2023. “Bouldering gyms are opening up in many urban areas, offering enthusiasts a chance to practice climbing without the need for extensive equipment,” affirms Robert Jamison, in charge of Business Development at Ontario-based IMPACT.

As in 2022, Quebec led the way in new climbing gym development in Canada, with developers DÉLIRE, UPLIFY and Bloc Shop all adding new locations in the province. Ontario, as well, gained multiple gym additions (Altitude Gym’s Orléans expansion gym and Reach Indoor Climbing). Also like last year, the net climbing gym growth rate in the country for 2023 (5.8%) was bolstered by few commercial climbing gyms—just one in 2023 (9eh Eastern Bloc in Ontario)—closing their doors.

Within the gyms, business leaders at IMPACT and DÉLIRE are seeing an ongoing shift in the industry—in Canada and elsewhere—toward more ecological practices and community building. “Environmental consciousness has permeated the climbing community. Gyms are making efforts to be more sustainable, using eco-friendly holds and building materials, and promoting Leave No Trace principles among climbers,” says Jamison. And Beaulieu and Lajoie say, “Climbing gyms are placing a strong emphasis on community building. They are hosting more events, workshops and competitions to foster a sense of belonging among members. This trend aligns with the social nature of climbing, encouraging inclusivity and cooperation.”

First Trade Show in Mexico

Arguably the biggest news related to Mexico’s climbing gym industry in 2023 did not have to do with a single climbing gym or gym chain. Rather, it was that Mexico featured its first-ever climbing industry trade show, CIMA, hosted by newly-opened Singular Climbing in Valle de Bravo in August. (Cima is the Spanish word for “summit;’ some videos of the CIMA panel sessions are available in Spanish here). Topics of the panel sessions included best practices for climbing gym ownership and operation, the future of routesetting, and climbing facility construction.

On the whole, the CIMA trade show indicated a large step forward, toward greater networking and synergy, for Mexico’s climbing gym industry. The trade show featured a Mexico-based climbing wall builder Muta Climbing, equipment developers (Acopa and MX), distributors (Vertimania, Exposure Climbing, Rabbit Mountain, Deporte Habitat and others), and gym operators from Adamanta, Sierra Elevation, Motion Boulder, Pico Norte, Singular Climbing and more. Routesetters and entrepreneurs looking to open gyms in Mexico in the future were also in attendance. “For me, [CIMA] was a magical experience, since CIMA got us all together and we could learn from different generations of climbers who are now living from their work in the climbing industry,” Javier Díaz of Sierra Elevation told CBJ.

In terms of gym data, one climbing gym in Mexico permanently closed in 2023: Corazón de Piedra in Durango. Offsetting that closure was the Singular Climbing opening and opening of a Pico Norte expansion gym (Pico Norte Climbing Tec Zone) in Monterrey. Along with such developments came news in November 2023 of a merger between Adamanta and Sierra Elevation gyms, which expanded Mexico’s largest climbing gym chain.

Beyond facility development, another big trend in Mexico throughout 2023 was overarching improvements, logistically and quantitatively, of climbing competitions in the country. For instance, Motion Boulder held a competition called “Get It,” which proved greatly popular; Adamanta held a series of competitions—“Lead Smash” and “Boulder Smash” (with a “Kids Smash” competition still forthcoming); and Pico Norte hosted “Summit Masters” and “Youth Masters” competitions. A number of high-profile competitors from the U.S.—including Nathaniel Coleman—traveled to Mexico to take part in some of the competitions. “I think the Mexican climbing industry has realized, especially big commercial gyms and big outdoor/climbing brands, that these big competitions are worth the investment and bring new types of customers who never [before] saw climbing as a sport,” Díaz stated.

More Unions Are on the Way

As previously mentioned, 2023 saw a measurable increase in formal unionizing efforts at climbing gyms around the U.S. Such efforts date back to 2021, when workers at Movement Crystal City in Virginia voted in favor of unionization and later became the first climbing gym union to be certified by the National Labor Relations Board. “Our main priority continues to be bargaining for a fair contract. We are also beginning conversations around elections for our board/formal structure,” says Crystal City organizer Wendy Low. Since then, employees at 15 more climbing gyms have followed suit. At the tail end of 2022, workers at VITAL’s West Harlem and Upper East gyms in Manhattan received their union certification, and months later workers at VITAL Brooklyn received theirs. Organizing together as Climbers United, the VITAL workers are expected to sign the first climbing gym union contract agreement in the coming weeks.

“Soon after signing, the Brooklyn bargaining committee will begin negotiations over an addendum that will cover issues discussed by workers of all classifications at the Williamsburg location,” says VITAL organizer Aaron Vanek. “We’re looking forward to seeing the progress we know we’ll be able to make, and are excited to continue making headway for workers in the climbing industry. We’re incredibly motivated by the recent climbing gym union victories at Movement Callowhill and Vertical Endeavors, and stand in solidarity with the team at Movement Crystal City…”

Those two union victories mentioned by Vanek both took place before the calendar turned to 2024. In Minnesota, workers at five Vertical Endeavors gyms—VE Bloomington, VE Minneapolis, VE St. Paul, Twin Cities Bouldering and VE Duluth—won their union election in November, represented by their local chapters of the United Food and Commercial Workers union. In addition to the breadth of the union—per a press release, about 90 people are employed across the bargaining unit—also noteworthy about the case was the NLRB’s decision that shift managers at the gyms are statutory employees rather than supervisors under the National Labor Relations Act and are therefore eligible to participate in the election and union, which may set a precedent for future rulings. The press release stated that employees at the nearby Nicros business, as well, are planning to unionize and “will be filing as a separate bargaining unit.”

Most recently, in December workers at the newly acquired Movement Callowhill gym in Pennsylvania became the latest Movement employees to vote in favor of unionization and are awaiting certification from the NLRB. Shortly after their election, workers at Movement Gowanus—another acquired gym—announced they’ll soon be having a union election of their own. And already in January, workers at five Touchstone gyms in Southern California—The Post (Pasadena), Hollywood Boulders (Hollywood), Verdigo Boulders (Burbank), Cliffs of ID (Culver City) and LA Boulders (DTLA)—announced their intent to unionize. Similar to the VITAL and Crystal City unions, the Touchstone, Gowanus and Callowhill organizers are being represented by their regional Workers United joint boards.

In other news at Movement, gym members in Chicago began mobilizing in December when Movement reportedly canceled fitness and yoga programs in the area and laid off employees in the area on relatively short notice. A petition started by the Chi Movement Solidarity organizers went live on January 8th. However, a union is not currently underway. Of note is that all the above collective actions have been taking place at climbing gym chains in the industry, a trend that has accompanied the burgeoning expansion trend.

Looking Ahead

Many of the developments in 2023 will likely have ripple effects that will continue into future years—but it’s too early to gauge exactly how or to what degree. As an illustration, it’s probable that more gyms will be challenged by lease issues in the coming years as more longstanding leases expire and more buildings change ownership. This matter seems particularly likely with older gyms and gyms operating in real estate markets that have substantially appreciated since the time of the gym’s opening.

Additionally, even though Vertical World largely refuted the details presented about that aforesaid auto belay accident that resulted in a multi-million-dollar settlement, the fact that a climbing gym and an auto belay manufacturer had to collectively pay millions of dollars will likely have long-lasting reverberations in the industry for years to come. New gym developers will likely consider the magnitude of that settlement in a cost/benefit ratio when deciding whether (or how best) to offer auto belays to a customer base.

At a more general level, 51 planned climbing gyms are currently scheduled to open across the U.S. and Canada in 2024 or after, which will include more expansion projects from larger gym chains: Six additional facilities are planned for The Gravity Vault, three for Central Rock, Movement and Sender One, and two apiece for Rock Spot, Touchstone and VITAL. Over half of these planned gyms will offer roped climbing walls (57%), which would be the largest annual percentage since 2016 (60%) if they all open in 2024; although, as previously noted, roped/mixed gyms can take more time to finish.

Whether or not the upcoming Paris Olympics will translate to increased gym development (or increased customer numbers for preexisting gyms) in North America remains to be seen. But 2023 certainly featured a trend of more “comp style” routesetting for a wide customer base at gyms—and this trend will likely continue in the coming year. “I think American gyms have a lot of catching up to do with the rest of the world, and not just the routesetters but the customers too. What we refer to as ‘compy’ tends to be fairly common everywhere else,” says Vini Campos, Head Routesetter for Movement Gowanus. (Read more about the routesetting trends of 2023 in the companion read to this article.)

In a growing industry like climbing’s, one thing’s for sure: 2024 is poised to be another fascinating year for commercial climbing gyms, in North America and around the world.

Methodology

CBJ is dedicated to researching and accurately reporting on climbing business activity in the industry. We strive to always be data-driven. The industry growth rate and accompanying data were compiled through several different source avenues and are completely original and proprietary to CBJ. Any climbing gym is welcome—and encouraged—to update or add their information to CBJ’s comprehensive gym map and dataset here.

Thank you to everyone who has supported and furthered this research, including the researchers who devoted many hours to collecting and fact-checking the gym data and the industry insiders who contributed keen insights, observations and opinions on the industry activity of 2023. And thanks to the team who has long supported CBJ’s research, in particular Joe Robinson (who put together the dashboard) and John Burgman (who wrote much of this report), Madeleine Eichorn and Amalia Wompa (who researched gym data), Naomi Stevens, Jamie Strong, CBJ publisher Scott Rennak, CBJ founders Mountain Helt and Marlowe Kulley, and map data guru Jon Lachelt.

Climbing Business Journal is an independent news outlet dedicated to covering the indoor climbing industry. Here you will find the latest coverage of climbing industry news, gym developments, industry best practices, risk management, climbing competitions, youth coaching and routesetting. Have an article idea? CBJ loves to hear from readers like you!