2015 was another good year for the indoor climbing industry. According to CBJ’s own data tracking the US commercial indoor climbing industry grew by 10% over last year, with 37 new gyms bringing the total number of commercial climbing facilities in the USA up to 388. There are several interesting aspects to this year’s growth, one of which is that this growth happened throughout the country.

California, and specifically Southern California, led the nation with 5 new climbing gyms, while 23 other states — as far reaching as Hawaii, Florida, Alaska and Louisiana — added at least one or more climbing facilities within their borders. This trend shows that climbing has strong staying power and that developers, lenders and investors are willing and excited to get into the business of selling climbing in new and non-traditional markets.

In addition to the widespread nature of development this year the other big trend is actually quite small. Only 5 US gyms opened with at least 25,000 square feet of climbing (SFC). In Canada none met that criteria. This is most likely due to the first time operator factor (see below) and that the majority of new gyms were built in smaller markets. These smaller gyms are a real departure from the last few years when we saw the rise of the mega gym with a new, “Largest Climbing Gym” crowned each year.

This year’s 10% growth rate is a very positive marker for the climbing industry. Since 2013 the growth rate has hovered in the low double digits each year, indicating that the indoor climbing industry has become a reliable business sector and a sustainable investment. CBJ research shows that the industry has been growing at a steady clip over the past 5 years during which time the growth rate has bloomed from a mere 5% in 2009 and 2010, to 2013 when we experienced the first signs of the modern gym rush with a 11% growth rate.

Wall Builders

Of the 49 new climbing walls that opened in the USA and Canada this year, nearly 40% (19 gyms) were owner built. While it is difficult to obtain climbing wall square footage for these types of walls, most of them were small, averaging 7,500 SFC, with at least two clocking in under 800 SFC.

The majority of the new climbing walls, both by number and total square footage, were designed and installed by professional wall builders. Walltopia maintained its lead in the industry and expanded its market share by building 10 new gyms totaling 145,000 SFC. Oregon-based Entre-Prises also increased its output over last year with 5 new facilities, while Rockwerx completed 4 projects and Vertical Solutions maintained their market presence with 3 projects. The remainder of the professional walls were installed by Eldorado, Leading Edge, Louie Anderson and a new Canadian wall builder, B121.

First Timers

Of all the new commercial climbing facilities that opened in the US this year, 22 of them were from first-time gym operators. This may not come as a surprise considering the variety of places that are seeing growth. Anyone that has taken notice of the industry’s rise wants to get in on the action before all the prime markets get snatched up. What is surprising is that these climbing entrepreneurs are taking the leap to open in small to mid-sized cities that traditionally have not been considered large enough to support the investment of a climbing gym.

These new first time operators built gyms that have under 10,000 SFC, with a few pushing into the 15,000 range. Gyms like Ascension Rock Club in Fairbanks Alaska, Teton Rock Gym in tiny Driggs, Idaho, Approach in Omaha, Nebraska and L’Escalade Fitness, in Lexington, Kentucky all brought traditional full-service gyms to untapped markets.

Another interesting note about these first time operators is that exactly half chose to open bouldering-only facilities. Center 45 in Boone, North Carolina, Stone Tree in Helena, Montana, New Orleans Boulder Lounge in Louisiana, and Urbana Bouldering in Urbana, Illinois are just a handful of the 11 first-timer bouldering gyms to open. This trend should also not come as much of a surprise as the capital requirements to open a bouldering gym are significantly less than a full-size facility and real estate searches can be significantly easier.

There is however one big exception to the first-timer trend and that’s First Ascent in Chicago, Illinois. Not many first time gym owners would think it wise to try to open two new facilities in the same year but that’s exactly what they did. Starting with a large 31,000 SFC traditional climbing gym near downtown, the First Ascent team moved on to open a 10,000 SFC bouldering-only facility also in Chicago. This was a bold step in an untested market. Chicago was, until last year, an unknown and untapped climbing market that the major players had avoided. That was until Brooklyn Boulders opened a Chicago facility in the heart of the city in 2014.

Big Gets Bigger

For the largest climbing gym operators, those with 4 or more facilities, 2015 was a quiet year. Touchstone, the largest of the large operators, announced 3 new gyms for the LA market but only opened one, a 20,000 SFC, bouldering gym they are calling The Cliffs of Id in Culver City, California. This bumps the Touchstone family up to ten. Meanwhile, Massachusetts-based companies Central Rock and Rock Spot, along with New York-based Brooklyn Boulders, each added one new facility to their respective portfolios.

San Diego-based Mesa Rim Climbing took a leap with their second full-scale facility and a new dedicated training center, putting the Mesa brand at 3 facilities. The Mesa Rim Training Center is the largest and most comprehensive in the US and is garnering quiet praise from coaches and athletes around the country. Unlike the three other training centers in the US, Mesa’s training center is not just for youth climbing team competitors. They allow and encourage adult members to use the facility and offer programing to fit the needs of athletes at all levels of performance. If successful, this type of facility could set the model for other operators to open full-service training centers. However, right now training centers are a slow moving, niche trend not likely to drive big changes in the industry for another five years.

Also taking their first steps out of their New Hampshire nest is up and comer Evo Rock which took the bold step of opening two new full-size facilities, one in Portland, Maine and another in Indianapolis, Indiana. Evo is in the process of building their 3rd in Louisville, Colorado and are testing the waters of franchising their brand.

Closed Doors

This year we saw 8 facilities in the US close for various reasons, which, according to CBJ research, is the largest number of closures the industry has ever seen in one year. However, when taken as a whole the rate is only 2% of the total gyms in the country.

One important aspect of the closed gyms is their age. All were more than 5 years old, except the youngest gym, The New Paltz Climbing Coop which opened in 2011 and unfortunately burned to the ground earlier this year; one was 13 years old and another was built almost two decades ago. All were under 18,000 SFC and operated in leased spaces.

In fact landlord issues and non-renewed leases contributed to several of the closures, including ClimbX and Vertical Endeavors – Warrenville. In Logan, Utah long time tenant The Rock Haus was not allowed to renew their lease and had to close shop earlier this year. Then just a few months after a new group of owners came into the exact same space and opened Elevation Climbing. The details are murky but should put lease agreements and their pitfalls on the radar for operators.

It’s important to note that only one gym closed due to direct competition. Grand Junction Climbing Center in Grand Junction, Colorado closed its doors early this spring. The 5,600 SF facility opened in 2010, although climbers had tackled its walls under various other brands, including Core Elements, Rock of Ages and the Climbery, since the early 1990’s. The latest iteration did not remain open very long after Grand Valley Climbing opened a brand new, purpose built facility housing 14,000 SFC about 1 mile away. This example could be seen as a warning to all other operators in a similar situation: modernize, expand or open a new facility or face the risk of a competitor stepping into, or right on top of, your market.

One operator that took that to heart this year was Spire Climbing Center in the college town of Bozeman, Montana. First built in 2004 with only 8,800 SFC, owner Jeff Ho met the challenge of modernization seriously by building onto his existing building and adding over 9,000 SFC for a total of 18,000 SFC.

Canada

The Canadian climbing gym market saw a 15% growth rate in new climbing gym openings over last year. That large uptick came from 9 gyms opening for a total of 69 commercial climbing gyms in Canada.

British Columbia saw the largest growth with five new gyms. The Hive opened their second bouldering-only facility in Vancouver, and Crag X moved into downtown Victoria after closing their original ten-year-old facility. The climbers of Squamish came together to open Ground Up Climbing Center, giving the Squamish climbers something to do on those all too often soggy rest days.

Calgary Climbing Centre, which is the largest gym developer in Canada brought a third gym to the Calgary area with their 22,000 SFC Hanger location. On the far east coast of Halifax, Seven Bays Bouldering opened the doors on their ultra hip, urban bouldering gym, while Délire Escalade opened their second bouldering-only gym in Quebec City.

As the large metro areas fill up it will be interesting to see what happens in Canada in the next few years. With only 5 gyms publically announcing plans for new gyms in 2016, it will be quite surprising if the Canadians see anywhere close to 15% growth in the near future.

Other trends

Other than new gyms popping up all over the place, established operators are getting savvy about marketing and operations. Specifically in the marketing department we’re seeing a lot more splashy, highly produced videos both for special events like competitions and for showcasing the gym to new customers. In essence they’re creating their own commercials without having to pay for advertising.

Another trend builds on the idea of the “3rd place”, or where people want to be when they are not at home or work. Brooklyn Boulders is the most cited example of a gym tapping into this trend, and the company has been very successful at marketing itself not just as a place to climb, but as a “new type of community space” where people can work, play and relax. With more gym owners putting serious thought into the design of their social spaces, with cafe-type amenities such as comfy couches, wifi and fresh roasted coffee, as well as offering a variety of social programming, climbers are getting more and more reasons to be at the gym.

Sober Reminder

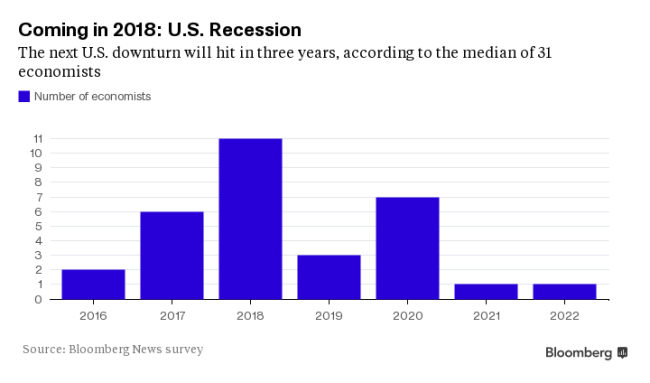

Even though it feels as if we haven’t recovered completely from the Great Recession, economic forecasters are reporting the eminent return of the next recession. The conclusion drawn from a Bloomberg survey of economists back in September, the median forecast of 31 respondents anticipated the next downturn occurring in 2018.

Assuming the collective wisdom of economists is right — which is a generous assumption given their mixed track record — it puts the current expansion on track to have a lifespan of about nine years. That’s a pretty good run, though the honor of the longest expansion on record would still belong to the decade that ended in March 2001.

However, according to some of the world’s major financial institutions 2016 will be the year of the next big global downturn. Cillian Doyle is an economist with the People Before Profit Alliance of Ireland and wrote in Counterpunch, “Daiwa – Japan’s second largest brokerage house – and Citibank both released reports in which they made a global financial meltdown in 2016 their baselines scenarios! Let that sink in for a minute; they’re not saying a meltdown next year is their worst case scenario, they’re saying it’s their assumed one!”

There is also no way to prevent a recession, only to weather it. When it does arrive, it is certain to have negative implications for the health and fitness sector, which relies on customers with disposable incomes. Gym operators may need to start thinking about what choices will help them make it through the next dip.

Looking forward

What we know right now is that 2016 is looking to be a possible record breaking year for US climbing gyms.

There are already 36 gyms that have publicly announced that they will be opening in 2016. That’s an expected 13% growth rate over this year which would be the highest rate on record. A lot of the growth could come from major players opening multiple facilities, like Touchstone and Gravity Vault. While other established brands such as Evo Rock, Mesa Rim, Momentum, Metro Rock and Earth Treks are planning to expand their reach into new markets with one gym each. And that’s just what has been already publicly announced. CBJ knows of at least a half dozen other large operators that may be opening new facilities in 2016.

Bouldering gyms may take a back seat to new traditional gyms in 2016. There are only 4 announced bouldering-only gyms in the US and Canada. However bouldering gyms can be built much faster than your typical full-service gym so we expect more announcements as the year progresses.

In the end, 2015 was a good year for the climbing industry. We saw major exposure due to the Dawn Wall phenomenon and the announcement that climbing is on the final short list for the 2020 Olympics. Major business publications printed stories about the climbing gym market heating up and VC’s are eyeing a possible entry into our little world.

Climbing Business Journal is an independent news outlet dedicated to covering the indoor climbing industry. Here you will find the latest coverage of climbing industry news, gym developments, industry best practices, risk management, climbing competitions, youth coaching and routesetting. Have an article idea? CBJ loves to hear from readers like you!