It’s been a roller coaster of a year for a lot of people that read CBJ, and no less so for the indoor climbing industry as a whole. In May, at the annual CWA conference, there were so many operators that announced plans to be open by the end of 2016 that we anticipated a 16% growth rate, which would have been a monumental record.

But as the year came to an end we found nearly a dozen experienced and first-time gym operators overestimated the speed at which they could open for business, or they encountered unforeseen delays in construction and permitting.

All that speculation and delay left the US with a relatively anemic 6.9% growth over last year, which is the lowest growth rate since 2012. In the United States, 27 new commercial climbing facilities opened for a grand total of 414 commercial climbing gyms at the end of the year (for Canada see below).

The lower growth rate should not bring worry to those that are taking their business plans to the bank or to those operators that are looking to expand. A 7% growth is still quite good for any industry and is not dramatically lower than the 9% average growth we have experienced since 2012.

We can point to several probable causes as to how 2016 shook out. (1) There are more gyms than ever, which means statistically, the growth rate will inevitably start to taper even as the industry continues to grow. (2) Older facilities still need capital improvements which mean operators have to choose between maintenance or expansion. (3) There is a trend of larger gyms entering more challenging urban markets (more expensive real estate; tougher building codes and permitting processes), which take a long time to go from idea to reality. These long lead times slow overall growth. (4) Several operators replaced their aging facilities with a brand new one, which is great for builders and the square footage count, but these new gyms do not count towards the growth rate (which only counts new additional facilities).

It’s also interesting to note that when you break out full-service climbing gyms and bouldering gyms, the trend looks quite different. This year there were 18 new full-service gyms, almost the same as last year; on the bouldering side there were only 9 new gyms that opened compared to 16 the year before.

Rehab

One reason for the slower growth rate could be the natural growth cycle of large multi-facility operations, those with more than three facilities. They have a disproportional effect on the industry because of their propensity for growth and their need to spend capital on existing facilities.

Consider what Touchstone and Planet Granite were up to in 2016. These two operators are two of the more active gym developers on the market, and they both operate multiple facilities on the West coast. But in 2016 Touchstone only opened one bouldering facility (Hollywood Boulders) and PG didn’t open any. Instead of opening more locations they both put their money into updating their existing locations. Among other things, Planet Granite added windows, updated padding and benches to their Sunnyvale location and updated padding, and shower upgrades along with a massive roof remodel at their Belmont facility, not to mention a brand new company website. Touchstone added roughly 6,000 SFC of new sport climbing to their Cliffs of Id location and 6,000 SFC to their Dogpatch facility (which goes towards the square footage count but not the industry growth rate).

Planet Granite also announced plans for two new gyms in the Chicago area (opening 2018), while Touchstone plans to open a facility in Burbank and perhaps rekindle their Pasadena project — along with any future projects they are keeping under their hats.

In a similar fashion, Salt Lake-based operator Momentum Indoor Climbing has also been rehabbing their Sandy location with new padding in their rope area while they wait for their two Houston area gyms to get started with construction. And Atlanta-based Stone Summit has also been in a holding pattern while they finalized details on a long-awaited (and much speculated) Texas facility; they also added more climbing square footage to their Atlanta facility.

Just Missed

Another aspect that large operators have on the industry is the number of facilities they didn’t open before the “ball” dropped on 2016.

Take New Jersey-based Gravity Vault, for instance. GV told CBJ earlier this year they would open four gyms in the US in 2016. But after numerous delays, including construction and permitting snags due to fire sprinkler inspections, they were only able to open doors on one location in Poughkeepsie, New York. If they had opened their other planned facilities in Melville, NY, Hoboken, NJ and Radnor, PA they would have been the top developer of the year.

Also on the miss list is Sender One – LAX, which has seen a non-stop medley of inspection-related delays. While their walls have been done for months and members have been enjoying member-only hours since November, the official public opening will have to wait until weather allows Sender to fully pave and stripe their parking lot early in the new year, which will allow them to get their official Certificate of Occupancy from the city.

In Boise, Idaho, Asana Climbing was putting the finishing touches on their new facility and hoped to be open before the end of the year. But just last week they had to put on the brakes after they failed one of the final inspections due to a hand rail. They now plan to open the first week of 2017.

Perhaps the most ambitious project to almost make it in 2016 goes to brothers Ammon and Jake Hartner and their undertaking to build The Edge in Idaho Falls, Idaho out of the salvaged remains of The Enclosure climbing gym that once resided in Jackson Hole, WY.

The Enclosure, first built by Rockwerx in 2008 and closed in 2014, was planned to be torn down and destroyed. “But now we’re keeping it alive for the local climbing community and plan on introducing the sport to many more people in a much more populous area here in Idaho Falls than Jackson,” Ammon Hartner told CBJ earlier this year.

The brothers completely dismantled and transported the entire climbing wall from Jackson to Idaho Falls and set about reconstructing and modifying it. They had help from wall builder Louie Anderson who added a few new features, raised the whole structure ten feet and mentored the Hartners in how to use concrete to skin the plywood. The gym will feature 17,000 SFC and what might be the most creative paint job of any gym in N. America! Sadly, the brothers didn’t quite make the cut off for being counted in 2016; they most likely will open doors to the public later this week.

New Operators

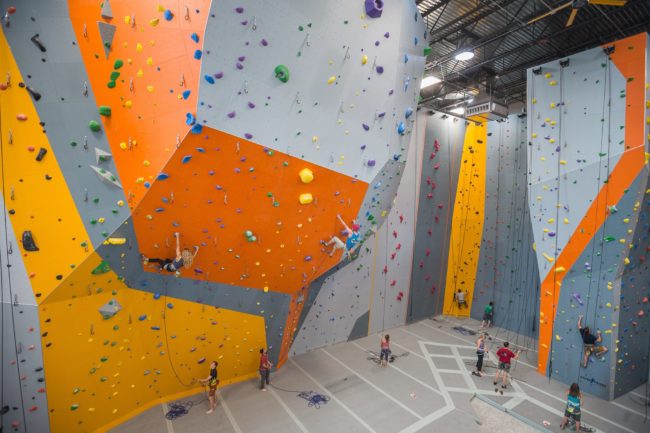

Of the twenty-seven new gyms in the US, 56% (15) were opened by first-time climbing gym operators. One look at a handful of these “first-timer” gyms and you might be surprised. The quality of the facilities, as well as the execution of the operations is far superior to what we’ve seen in the past. Gyms like The Crux in Austin, Zenith in Springfield Missouri, Ascent Studio in Fort Collins, Cliff Hangers in Mooresville, NC and Rock Mill in Akron all have well-designed facilities with professionally built walls and robust management systems that shows they took the time to learn and plan before heading to the bank.

What this also shows is that new operators are stepping up to the plate ready to compete and stand their ground in a growing competitive market. This will be vitally important in the coming years as competition heats up even in small to mid-size towns.

Trading Up

There were several gyms in the US that took the bold step to open brand new facilities to replace their aging gyms.

Alaska Rock Gym has been serving the needs of Anchorage climbers since 1995 and since then the gym had become chronically over-crowded. So the team decided to build a beautiful 24,000 square foot ground-up building and have Entre Prises construct the walls. The gym features all the amenities you would expect from a state-of-the-art facility including an in-house routesetting lift (the original gym was housed in a leased space and closed when the new facility opened).

In a similar situation, the Warehouse Rock Gym in Olympia, Washington teamed up with a local developer to create a brand new ground-up facility and gave it a new name, The Cirque, which opened just after Christmas.

The Wilmington Rock gym took a slightly different route to opening when they bought the climbing walls from a church in Hendersonville, Tennessee and moved them to their new home in North Carolina. The EP Imprint panels were combined with some owner-built plywood walls to bring 3,000 SFC to the Wilmington community (pop: 115,000).

Last but not least, the Sante Fe Climbing Center moved a few miles down the road to upgrade to a beautiful new facility that features 6,000 SFC roped climbing and bouldering as well as a separate kids area and expanded training area.

Wall Builders

Professional climbing wall builders did a brisk business this year, but none better than Walltopia. For the first time since CBJ has been keeping records, a commercial wall builder eclipsed the number of owner-built walls. The Bulgarian-based wall builder absolutely dominated the market in both the US and Canada by capturing nearly 40% of all new commercial projects completed this year.

Not only did they sign more contracts, they also put up the most wall surface. Walltopia branded walls accounted for more than 40% of the total climbing square footage opened in North America this year, almost 175,000 SFC. This dwarfs their next two competitors, owner-built and Rockwerx, who each installed roughly 40,000 SFC this year.

One reason for Walltopia’s spike this year is the capture of repeat customers and large developers; more than half of experienced developers opening their second or third (or eleventh) location selected Walltopia to build their walls. The builder also did well with first-timers, who were as likely to sign with Walltopia as they were to build their own walls.

As mentioned above, owner-built climbing walls account for a big chunk of the market, just over 20% of all new projects, although since these projects tend to be smaller they account for just 10% of the total square footage installed this year. As the industry matures and conventional financing, with all the added hoops that bankers need developers to jump through, becomes more commonplace, we are expecting the number of owner-built walls to decrease even further, especially full-service sport and bouldering gyms.

Rockwerx gave a strong showing this year by building three new facilities, including the beautiful Cliff Hangers in Mooresville, NC, and also installed a 6,000 SFC expansion to SportRock in Sterling, VA. Entre-Prises came in fourth by building two commercial climbing facilities, Alaska Rock Gym and Ascent Studio in Fort Collins, CO.

As with all of CBJ’s numbers, we only count commercial climbing facilities and not recreation centers or university walls. However, a sizeable percentage of work for these wall builders does come from the institutional side of the industry. In fact, without it, many of these wall builders would not be in business.

Canada

There are now 84 commercial climbing facilities in Canada thanks to the addition of 13 new gyms across the country. Those new gyms boosted the growth rate up to 18% over last year!

One notable aspect of the Canadian gyms this year is the trend toward smaller gyms. The average size of the full-service gyms built this year was around 6,750 SFC, and for bouldering gyms it was 3,250 SFC (in the US it was around 13,750 SFC and 6,000 SFC, respectively). In this way the Canadian market acts more like the European and Asian models: which have smaller and more densely packed gyms in urban centers. Seven of the thirteen gyms that opened were bouldering-only gyms, with Rock Jungle Boulders in Edmonton, Alberta being the largest bouldering gym at 7,000 SFC. Three and half hours northeast of Quebec City in the town of Rimouski (pop: 46,000), a tiny co-op called Riki Bloc opened with just 1,000 SFC and reports to have 350 members.

The largest of the Canadian pack this past year was the 10,000 SFC sport climbing, bouldering and Ninja Warrior facility opened by Aspire Climbing in Milton, Ontario, which doubles as the headquarters for Rockwerx Canada.

The majority of Canadian development centered around Toronto, which saw five new gyms open. There are now 15 bouldering or full-service climbing gyms in the Toronto metro area (pop: 6 million) with another three planned for 2017.

At this time last year only five gyms had publicly announced for Canada. With thirteen now open, it goes to show that smaller gyms, and bouldering gyms in particular, have a distinct advantage in the speed at which they can open.

Closures

Only four facilities closed this year which is a significant improvement over 2015 (which saw 8 closures) but average for the industry. But just like last year, most closures were due to lease issues and rarely from competition.

In Ventura, California, Vertical Heaven, a bouldering-only facility which opened in 2013 by climbing hold entrepreneur Mark Bradley, who was also one of the creators of Kingdom Holds and now owns Working Class Holds, closed its doors. Bradley attempted to sell the gym for personal reasons in late 2015. But in January, on Vertical Heaven’s Facebook page there was a post stating that their prospective buyer had pulled out of the deal and the gym never reopened. The Ventura/Oxnard area has over 310,000 residents and VH was the area’s only commercial climbing facility.

Other big news in California was the closure of Vertical Hold’s single location in San Diego, which opened in 1993. The business was pushed out by the expansion of a neighboring brewery. In a surprising turn of events, the owners of Solid Rock, a chain of three gyms also in the San Diego area, sold their company to Vertical Hold. Vertical Hold will still have to close their original location but now they will own and operate the three Solid Rock locations, which are being rebranded as Vertical Hold.

On the other coast Stronghold, which opened in 1994 in Columbia, South Carolina, didn’t exactly go out of business but they no longer have climbing walls. After a move to a new location, Stronghold, which is also a day spa and fitness center, was unable to bring their climbing tower and bouldering walls. Stronghold did not respond to CBJ as to why they were not able to move the climbing walls. However, on their website the owners wrote, “But rest assured, all ye faithful climbers; plans for a new gym dedicated to climbing are in the works!” Stronghold was the only commercial climbing facility in Columbia, SC (pop: 133,800).

Finally, Iron Palm, which opened in 2013, was a small bouldering-only gym in Asheville, North Carolina (pop: 87,000). They closed their doors due to direct competition from a new full-service climbing gym. That’s according to Iron Palm founder, Mark Martines, who told CBJ that he was squeezed out after the new Smoky Mountain Adventure Center opened this year. The SMAC is a large multi-outdoor sports facility that has top-rope, lead climbing and autobelays in addition to a bouldering area. The climbing operation is leased to ClimbMax, a local gym operator with one other facility in Asheville.

The advantage for SMAC is not so much about the size of their new facility but in the combined value and brand awareness of the ClimbMax name. It also didn’t hurt that SMAC received a $100,000 Tourist Product Development Fund grant from the county and secured a $25,000 grant from the Pigeon River Fund for a bank stabilization and steps down to the river, making for easier access for folks renting gear from the Adventure Center.

With advantages such as these, Iron Palm had a hard time competing and closed up shop. Martines said he has no plans to open another climbing gym.

Looking Ahead

Today we are exactly at the same place we were last year at this time. There are thirty-six gyms that have publically announced they will open in 2017 (plus the six that barely missed for 2016). As we’ve seen this year not all of those will open on time.

The indoor climbing industry is gearing up for the possible effects of having climbing in the Olympics in 2020. A few years ago, speed climbing walls were starting to go out of fashion. Now that speed will be part of the combined Olympic format, gym developers will be looking to find space for this often unappreciated climbing feature.

It’s still unknown how the Olympics will boost the success of climbing gyms. If the climbing portion of the games gets covered on broadcast television, and if American and Canadian athletes qualify (and do well) we could see a growth in dedicated training facilities over the next three years. However, it’s not likely that in the next few years we’ll see a huge bump in growth purely because of the Olympics. But, depending on the marketing savvy of current operators, we could see a rise in interest in youth programing, which would boost the size of competitive teams and the amount of revenue those teams produce.

Because of the costs of real estate and the slow building phase, large developers will most likely start to rethink opening facilities over 25,000 SFC and instead opt for more, smaller facilities. The US market could start to look more like the Canadian scene with more bouldering gyms and gyms under 10,000 SFC packed into metro areas. Particularly areas with millions of people and bad traffic, such as Chicago, Seattle, SoCal and many of the major cities on the eastern seaboard, are likely to follow this path.

In big cities like Houston, Dallas, and Orlando, we’re still likely to see mega facilities over 25,000 SFC only because the land is cheaper and the climbing market relatively undeveloped.

Regardless of how big and where exactly the market grows, the future still looks bright for the climbing industry!

Climbing Business Journal is an independent news outlet dedicated to covering the indoor climbing industry. Here you will find the latest coverage of climbing industry news, gym developments, industry best practices, risk management, climbing competitions, youth coaching and routesetting. Have an article idea? CBJ loves to hear from readers like you!